Common menu bar links

Breadcrumb Trail

ARCHIVED - Performance Reporting: Good Practices Handbook 2011

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Provide factual, independently verifiable, evidence-based performance information

Discussion of the department’s performance should be substantiated with factual, independently verifiable, evidence-based information. Balanced, evidenced-based reporting leads to realistic conclusions about the department’s performance and gives readers confidence in those conclusions.

In order for readers to have confidence in the methodology and data used to substantiate reported performance, an indication of the validity and credibility of data used should be provided. This can be achieved by indicating the source of the information, particularly if graphs or tables are presented. A brief discussion of the measures taken to ensure the reliability of the data upon which the performance report is based is also important, whether for data from internal sources or for data collected from external partners. Both qualitative and quantitative data are sources of valid performance information. Limitations or problems with the underlying data and any caveats regarding proper interpretation of the information reported should also be noted.

Identifying sources of data (information) is critical to establishing credibility. It offers readers the opportunity to directly validate what has been included in the report and provides a reference point when seeking further information.

For example, when presenting survey data in performance reports, providing information on the quality and limitations of survey results helps substantiate performance claims. The importance of this criterion is highlighted in the 2005 November Report of the Auditor General of Canada,Chapter 2, “The Quality and Reporting of Surveys.”[1]

Findings presented in approved evaluation and audit reports can be a key credible source of performance analysis. Departments should reference any significant findings, explain the relationship to departmental performance, and identify the next course of action to improve departmental results.

Good practice: Provide factual, independently verifiable, evidence-based performance information (use findings of audits and evaluations in performance discussions).

Why is the following a good practice? Throughout the DPR, numerous references are made to evaluations and internal management reviews. Results of an evaluation are discussed in the context of redesigning program delivery.

Good practice example: Atlantic Canada Opportunities Agency DPR 2009–10

Good practice (example 2): Provide factual, independently verifiable, evidence-based performance information (data).

Why is the following a good practice? The DPR discloses the level of assurance on the reliability and relevance of performance information. The reader has a clear understanding of where and how the information was obtained. The DPR identifies sources of data, and any limitations or problems with underlying data are reported.

Good practice example: Industry Canada DPR 2009–10

Provide informative financial tables

Basic to performance reporting is linking resources to results (to be discussed in more depth under Principle 4); therefore, an accurate and thorough presentation of financial tables (i.e., resources) is key for ensuring accountability to Parliament. In addition, financial tables illustrate the link to the appropriations given to departments through the supply process. The content, layout, and format of financial tables need to be clear and easy to understand and interpret, thereby contributing to the user-friendliness of the report.

Immediately following financial tables should be a discussion of their content. Just as the tables should be easy to understand and interpret, explanations of their content should be clear, simple, and effective so that a layperson can interpret the information, see links between resources and results, and make informed conclusions.

There should also be a hyperlink in the report that brings the reader directly to the departmental financial statements.

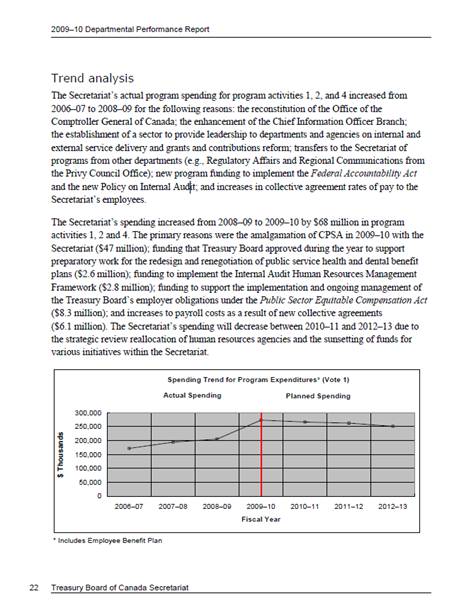

Good practice: Provide informative financial tables (Expenditure Profile).

Why is the following a good practice? The financial tables in this DPR are presented clearly and are easy to understand. Included is a discussion of the financial trends that emerge from an analysis of the data. Explanations are effective in integrating financial tables to non-financial performance discussions in the report. Altogether, financial information underpins non-financial performance.

Good practice example: Treasury Board of Canada Secretariat DPR 2009–10

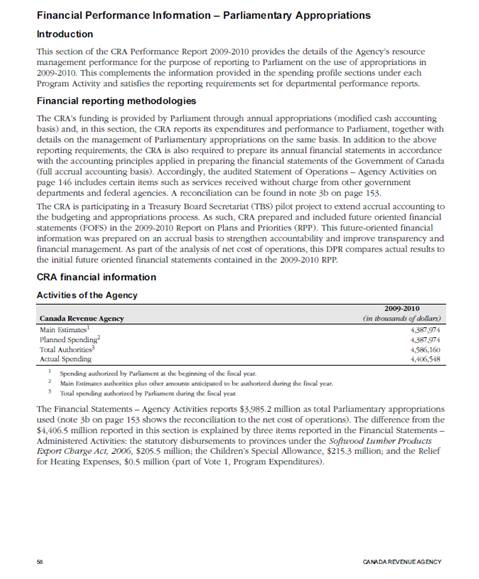

Good practice (example 2): Provide informative financial tables (financial highlights).

Why is the following a good practice? Expenditure tables and financial information are clear throughout the report, with good explanations of variances in the expenditure profile found on pages 23 to 25. Text supporting the tables and graphics is at a level of reporting that conveys meaningful understanding of the agency’s financial position and costs of operations; for example, the report provides the program-level reasons that influenced changes in its costs of operations (pages 58 and 59). The DPR also includes the analysis of its costs of operations in the context of a comparison with its future-oriented financial statements.

Good practice example: Canada Revenue Agency DPR 2009–10

[1]. 2005 November Report of the Auditor General of Canada