Guide to Travel, Hospitality, Conference and Event Expenditures

More information

Directive:

Terminology:

Hierarchy

1. Date of publication

This guide was published on and incorporates changes effective as of .

This guide replaces the Guideline on Travel, Hospitality, Conference and Event Expenditures dated .

2. Application, purpose and scope

This guide applies to the organizations listed in section 6 of the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures (the Treasury Board Directive).

This guide outlines recommended best practices for implementing the Treasury Board Directive. Examples and tips are provided for illustrative purposes only and may not apply to all departments or situations.

Grants and contribution payments made in accordance with the Policy on Transfer Payments are not subject to the provisions of the Treasury Board Directive.

3. Guiding principles

When planning travel, hospitality, conference and event expenditures, individuals with delegated approval authority are to exercise professional judgment in determining whether the expenditures meet the objective of the Policy on Financial ManagementFootnote 1.

According to section 4.2 of the Treasury Board Directive, individuals with delegated approval authorities are responsible for ensuring that the costs of travel, hospitality, conference and events are minimized and are necessary to support the departmental mandate, operational activities, objectives or priorities, while ensuring that the provisions of legislation, regulations, orders-in-council, National Joint Council directives, collective agreements or Treasury Board–approved instruments are respected.

Table 1 illustrates the principles that should guide the planning, approval, recording and reporting of travel, hospitality, conference and event expenditures. Individuals with delegated authority should consider the questions in column two to ensure that these principles are respected.

| Guiding principles | Questions | Examples |

|---|---|---|

| Public scrutiny | Would Canadians agree that the expenditure is necessary for the department to achieve its objectives? | A manager’s decision to use public funds to buy coffee and snacks for a team meeting would not stand up to public scrutiny. |

| Value for money | Is there a more cost-effective way to achieve departmental objectives (for example, remote meeting solutions)?

Are the minimum number of attendees travelling or participating in the event? |

Having a regional manager from Vancouver travel to the National Capital Region for a short, routine meeting would not represent good value for money. Participation by teleconference, for example, would be more cost-effective. |

| Accountability | Are effective oversight, accountabilities and controls in place to monitor these expenditures in the department, and are they documented?

Have the responsibilities set out in the Treasury Board Directive been clearly communicated? |

A department regularly reviews conference expenditures to ensure that they are aligned with approved plans and within authorization levels. |

| Transparency | Is the information released for reporting accurate and complete? | Expenditures are properly coded in the financial management system to allow for accurate and complete reporting of the information published. |

4. Overview of travel, hospitality, conference and event expenditures

Appendices A to D provide guidance for the planning, approval and reporting of travel, hospitality, conference and event expenditures. These appendices explain specific requirements in the Treasury Board Directive by providing best practices and examples. Appendix E describes how taxes (for example, the Goods and Services Tax / Harmonized Sales Tax) are to be planned for and recorded. Appendix F provides guidance on the transparency of these expenditures, and appendices G, H and I provide guidance on the annual reporting of travel, hospitality and conference expenditures.

The Treasury Board Directive supports the implementation of the National Joint Council Travel Directive and the Special Travel Authorities, which detail the requirements for individuals travelling on government business, including Governor in Council appointees. Contact your designated departmental travel coordinator for guidance on these requirements.

Table 2 summarizes the approval authorities and thresholds for each type of expenditure. More information is provided in appendices A to D.

| Expenditure type | Approval authorities | Appendix |

|---|---|---|

| Travel | Senior departmental managers (SDMs) approve travel expenditures, but approval may be delegated below the SDM level | A |

| Hospitality |

|

B |

| Conference | SDMs approve conference expenditures | C |

| Events |

|

D |

5. References

Legislation

- Access to Information Act

- Financial Administration Act (sections 7 and 9)

- Privacy Act

Related policy instruments

Other relevant documents

- Global Affairs Canada policy on Official Hospitality Outside Canada

- Guide to the Proactive Publication of Travel and Hospitality Expenses

- Government-wide chart of accounts for Canada

- Heads of Post and Foreign Service Official Hospitality directives

- National Joint Council Foreign Service Directives

- National Joint Council Isolated Posts and Government Housing Directive

- National Joint Council Relocation Directive

- National Joint Council Travel Directive

- Policies for Ministers’ Offices

- Special Travel Authorities

- Values and Ethics Code for the Public Sector

- Information Bulletin: Conference attendance by members of the Research (RE) group

6. Enquiries

Members of the public may contact Treasury Board of Canada Secretariat Public Enquiries if they have questions about this guide.

Individuals from departments should contact their departmental financial policy group if they have questions about this guide.

Individuals from a departmental financial policy group may contact Financial Management Enquiries for interpretation of this guide.

Appendix A: Travel

A.1 Introduction

This appendix discusses best practices for developing travel plans, explains the travel approval authorities and illustrates the reporting of travel expenses.

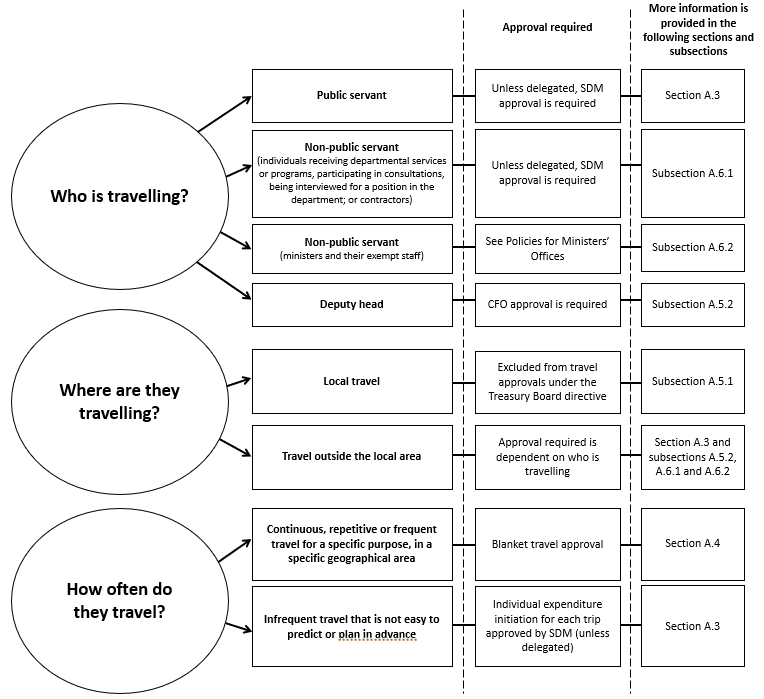

The travel approval authorities described in this appendix are organized according to the answers to the following three questions, as illustrated in Figure 1:

- Who is travelling?

- Where are they travelling?

- How often do they travel?

Figure 1: Text version

This figure provides an overview of the content discussed in Appendix A. It presents the travel approval authorities according to the answers to the following three questions:

- Who is travelling?

- Where are they travelling?

- How often do they travel?

| Who is travelling? | Approval required | More information is provided in the following sections and subsections |

|---|---|---|

| Public servant | Unless delegated, senior departmental manager approval is required | Section A.3 |

| Non-public servant (individuals receiving departmental services or programs, participating in consultations, being interviewed for a position in the department; or contractors) | Unless delegated, senior departmental manager approval is required | Subsection A.6.1 |

| Non-public servant (ministers and their exempt staff) | See the publication “Policies for Ministers’ Offices” | Subsection A.6.2 |

| Deputy head | chief financial officer approval is required | Subsection A.5.2 |

| Where are they travelling? | Approval required | More information is provided in the following sections and subsections |

|---|---|---|

| Local travel | Excluded from travel approvals under the Treasury Board Directive | Subsection A.5.1 |

| Travel outside the local area | Approval required is dependent on who is travelling | Section A.3 and subsections A.5.2, A.6.1 and A.6.2 |

| How often do they travel? | Approval required | More information is provided in the following sections |

|---|---|---|

| Continuous, repetitive or frequent travel for a specific purpose, in a specific geographical area | Blanket travel approval | Section A.4 |

| Infrequent travel that is not easy to predict or plan in advance | Individual expenditure initiation for each trip approved by the senior departmental manager (unless delegated) | Section A.3 |

Legend

- CFO:

- chief financial officer

- SDM:

- senior departmental manager

- Treasury Board Directive:

- Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures

A.2 Travel planning

In accordance with the guiding principles in section 3 of this guide and subsection A.2.2.1 of the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures (the Treasury Board Directive), the chief financial officer (CFO) is responsible for ensuring that travel is avoided where appropriate and that travel is cost-efficient, including:

- limiting the number of departmental travellers to the minimum necessary to deliver the business of the government

- selecting the most economical means of travel when booking transportation, accommodations and meeting facilities

Departments can use travel plans to support the following:

- the departmental travel approval process

- management oversight and resource planning to ensure cost-efficient travel decisions

The following questions and answers explain the key aspects of travel plans.

What is a travel plan?

A travel plan is a document that contains information about travel requirements for employees over a specific period.

When should a travel plan be used?

A travel plan can be useful in situations where departments can predict in detail who will need to travel, as well as when and where the travel will occur.

What should be included in a travel plan?

When the travel plan is used to obtain expenditure initiation approval, it should contain detailed estimates of travel costs and a rationale for why the travel is required, as described in subsection A.2.2.8 of the Treasury Board Directive.

If travel expenditures for companions are permitted under legislation, regulations, orders-in-council, National Joint Council directives or Treasury Board–approved instruments, or approved as per subsection A.2.2.12 of the Treasury Board Directive, the authority should be documented in the travel plan or in the travel request. Further information on companion travel can be found in subsection A.6.3 of this guide.

How often should a travel plan be prepared?

Travel plans can be prepared monthly, quarterly, semi-annually or annually, depending on a department’s operational needs.

What is the development and approval process for travel plans?

The CFO should:

- develop and coordinate the department’s travel plan process, including the format and content of travel plans

- establish procedures for approving travel plans and for approving trips not included in those plans

- present the consolidated departmental travel plan to the department’s executive management committees to support effective management oversight and resource planning

To maximize efficiencies in the approval process, approvals of travel plans and events can be coordinated (see section D.2 of this guide for more information on combining travel approval with event approval).

A.3 Delegation of travel approval authority

The senior departmental manager can be delegated the authority to approve travel expenditures. Departments may decide to delegate travel approval authority below the senior departmental manager level if at least one of the following three operational needs listed in subsection A.2.2.4 of the Treasury Board Directive is met:

- the program’s operations are regionally or globally dispersed, and there is no senior departmental manager present in certain offices

- the operational requirements for travel are frequent, may involve a significant number of travellers, and concentrating approvals with one position would create potential delays

- the potential for delay in obtaining approval could be injurious to the public interest or the timely delivery of departmental services or operations

When delegating below the senior departmental manager level, departments should consider, on the basis of operational needs, how many and which managers should exercise the delegations.

As part of their maintenance of delegated spending and financial authorities, CFOs should formally document delegated travel approval authorities and should review them at least once a year to ensure that they are still relevant.

For more information on documenting delegations, see the Directive on Delegation of Spending and Financial Authorities.

A.4 Blanket travel authority

According to the National Joint Council Travel Directive (the NJC Travel Directive), blanket travel authority (BTA) is an authorization for travel that is continuous or repetitive in nature, with no variation in the specific terms and conditions of trips, and where it is not practical or administratively efficient to obtain prior approval from the employer for each trip. Any exceptions to the BTA parameters shall require that each trip be specifically approved, prior to travel status, where possible. BTA does not apply to groups of employees. Employees may have more than one BTA simultaneously.

BTAs are to include reasonable estimates of costs and related elements from the checklist of trip authorization elements in subsection A.2.2.8 of the Treasury Board Directive (see subsection A.7.1 of this guide for additional information).

The approval authority level for a BTA is based on the estimated travel costs per travel activity, not the total amount of the BTA. The approval of BTAs depends on the departmental delegation chart of spending and financial authorities. Approval of BTAs can be to positions identified by title.

BTAs should be included as part of the departmental travel plan (see subsection A.2 of this guide).

CFOs should ensure that the approval of BTAs is formally documented and reviewed at least once a year.

If an individual has to travel to attend an event, the expenditure initiation approval for the event takes precedence over any BTA that is in place for that individual. Therefore, the travel costs otherwise approved under a BTA are to be included in the total departmental estimate of event costs.

The NJC Travel Directive provides guidance on creating and determining the content of BTAs. Contact your designated departmental travel coordinator or your departmental financial policy group for more information on BTAs.

A.5 Treatment of other travel approval authorities

A.5.1 Local travel

According to subsection A.2.2.6.1 of the Treasury Board Directive, travel approval authorities under the Treasury Board Directive do not apply to local travel within the normal office location and surrounding working area of a public servant.

Departments should define local travel to reflect their operational circumstances. The definition of “local travel” should include the limits under which local travel would be excluded from the travel approvals in the Treasury Board Directive. Departments should define and document the approval authorities for local travel, for example in their supporting notes to the delegation chart.

Departmental definitions of local travel apply to expenditure initiation authority for travel and are independent of the definitions relating to travel entitlements in the various modules of the NJC travel directive. Contact your designated departmental travel coordinator or your departmental financial policy group for more information.

A.5.2 Approval authority for travel by the deputy head

According to subsection A.2.2.9 of the Treasury Board Directive, the CFO must approve travel by the deputy head. Departments should establish written policies or procedures for approval and payment of the deputy head’s travel expenses.

A.6 Travel of non-public servants

A.6.1 Travel of non-public servants

For the purpose of the Treasury Board Directive, non-public servants include the following:

- Canadians who are travelling to receive departmental services and programs

- individuals who are participating in departmental consultations and negotiations

- contractors who are doing the work specified in their contract

- individuals who are being interviewed for employment in the department

When a contract sets out travel requirements and states that the contractor will be reimbursed for travel costs, any travel by the contractor must be explicitly approved. If it is determined that the contractor will need to travel after the contract is signed, a subsequent travel approval is required.

The department should determine where in the contracting process it is most efficient and effective to obtain the necessary travel approval authority.

A.6.2 Travel of ministers and their exempt staff

According to subsection A.2.2.3 of the Treasury Board Directive, travel undertaken in support of departmental business by appropriate ministers and their exempt staff is not subject to travel expenditure initiation under the Treasury Board Directive. This travel falls under the Policies for Ministers’ Offices and the Special Travel Authorities.

The CFO should advise the minister’s chief of staff on the development of relevant procedures.

A.6.3 Companion travel

A minister can approve companion travel in accordance with subsection A.2.2.12 of the Treasury Board Directive. The minister may choose to approve on a case-by-case basis or for types of situations. Examples could include attending key award and recognition ceremonies or activities requiring participation of companions for reason of protocol or diplomacy. This authority can only be delegated to the deputy head.

Companion travel authorized under legislation, regulations, orders-in-council, National Joint Council directives or Treasury Board–approved instruments are not subject to the restrictions of the Treasury Board Directive.

In situations where there are existing authorities to allow for companion travel, the authority should be documented in the travel plan or in the travel request as described in subsection A.2 of this guide.

A.7 Reporting travel expenses

A.7.1 Recording trip authorization elements

Departments need to ensure that the trip authorization elements are included in the travel authorization for expenditure initiation purposes when the department pays travel costs for a public servant or a non-public servant.

The trip authorization elements are to be captured and recorded for each trip or in a travel plan.

The trip authorization elements, as described in subsection A.2.2.8 of the Treasury Board Directive, are as follows:

- Objective

- Category (see subsection A.7.2 of this guide for more information)

- Traveller as public servant or non-public servant

- Virtual presence or other remote meeting solutions

- Number of travellers

- Mode of transportation (including the six modes of transportation)

- Accommodations

- Meals

- Incidentals and other costs

As described in subsection A.2.2.13 of the Treasury Board Directive, the following trip authorization elements must be recorded in either the departmental financial management system, a related system (such as the Shared Travel Services travel authorization module or a departmental online system) or a departmental process that uses travel authorization forms:

- B. Category

- F. Mode of transportation (including the six modes of transportation)

- G. Accommodations

- H. Meals

- I. Incidentals and other costs

It is expected that the departmental financial management system will directly capture the trip authorization elements through the use of general ledger codes aligned with the 10 detailed object codes in the government-wide chart of accounts for Canada (see section A.7.3 of this guide) if the department chooses not to use a related system.

A.7.2 Categories of travel

According to subsection A.2.2.7 of the Treasury Board Directive, one of the following five travel categories must be recorded as element B in the trip authorization elements (described in subsection A.7.1 of this guide):

- Operational activities: travel required to support the department’s operational activities (other than the following categories), legislative or legal requirements

- Key stakeholders: travel necessary to engage key stakeholders in relation to such matters as policy, program or regulatory development or renewal

- Internal governance: travel necessary to support sound internal departmental governance

- Training: travel to enable the training of public servants

- Other travel

The “operational activities” category should be selected for activities that meet the definition of operational activities and for travel that does not fit with the definition of “key stakeholders,” “internal governance” or “training.”

The “key stakeholders” or “internal governance” categories should be selected when they represent the main purpose of the travel, even if the trip includes some aspects of “operational activities.”

The following examples illustrate the selection of the appropriate travel category in different situations:

- record the costs for departmental employees to travel to engage with stakeholders on the design of a new departmental program as “key stakeholders” even if the program is considered one of the department’s “operational activities”

- record the travel costs of Departmental Audit Committee members as “internal governance”

- record the costs for a food inspector to travel to a meat-processing plant to perform a food safety inspection as “operational activities”

A.7.3 Economic object codes for the travel of public servants and non-public servants

Travel costs are to be recorded using the economic object code for the appropriate category of public servant and non-public servant travel listed in the government-wide chart of accounts for Canada, as illustrated in Table 3.

| Travel category | Economic object code for public servants | Economic object code for non-public servants1 |

|---|---|---|

|

||

| Operational activities | 0251 | 0261 |

| Key stakeholders | 0252 | 0262 |

| Internal governance | 0253 | 0263 |

| Training | 0254 | 0264 |

| Other travel2 | 0255 | 0265 |

Appendix B: Hospitality

B.1 Introduction

According to the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures (the Treasury Board Directive), hospitality consists of the provision of meals, beverages or refreshments that are necessary for the effective conduct of government business and for reasons of courtesy, diplomacy or protocol.

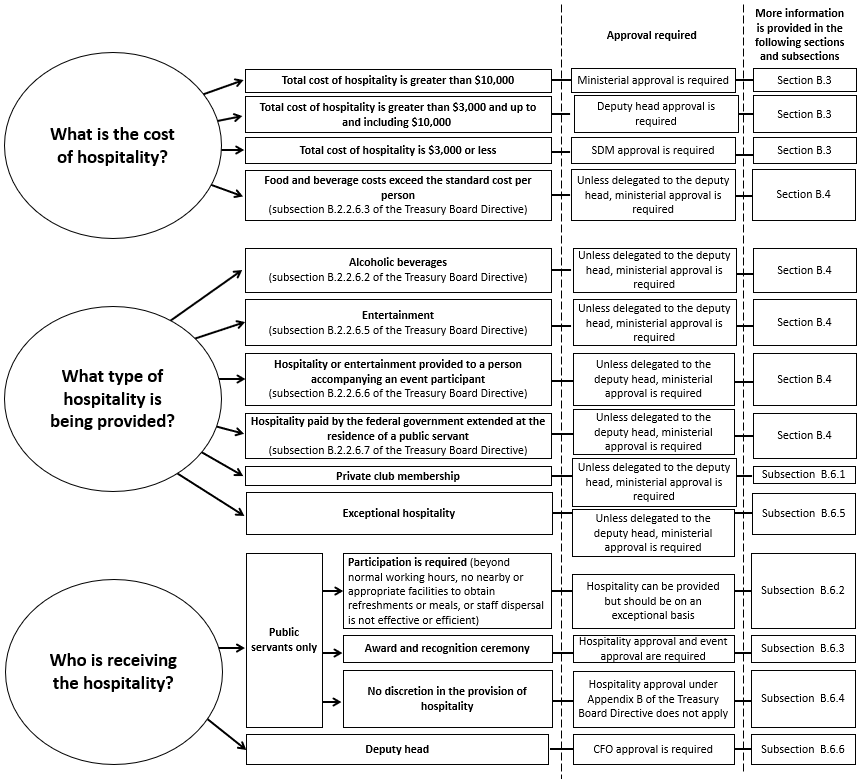

The hospitality approval authorities described in this appendix are organized according to the answers to the following three questions, as illustrated in Figure 2:

- What is the cost of hospitality?

- What type of hospitality is being provided?

- Who is receiving the hospitality?

Figure 2: Text version

This figure provides an overview of the content discussed in Appendix B. It presents the hospitality approval authorities according to the answers to the following three questions:

- What is the cost of hospitality?

- What type of hospitality is being provided?

- Who is receiving the hospitality?

| What is the cost of hospitality? | Approval required | More information is provided in the following sections |

|---|---|---|

| Total cost of hospitality is greater than $10,000 | Ministerial approval is required | Section B.3 |

| Total cost of hospitality is greater than $3,000 and up to and including $10,000 | Deputy head approval is required | Section B.3 |

| Total cost of hospitality is $3,000 or less | Senior departmental manager approval is required | Section B.3 |

| Food and beverage costs exceed the standard cost per person (subsection B.2.2.6.3 of the Treasury Board Directive) | Unless delegated to the deputy head, ministerial approval is required | Section B.4 |

| What type of hospitality is being provided? | Approval required | More information is provided in the following sections and subsections |

|---|---|---|

| Alcoholic beverages (subsection B.2.2.6.2 of the Treasury Board Directive) | Unless delegated to the deputy head, ministerial approval is required | Section B.4 |

| Entertainment (subsection B.2.2.6.5 of the Treasury Board Directive) | Unless delegated to the deputy head, ministerial approval is required | Section B.4 |

| Hospitality and entertainment provided to a person accompanying an event participant (subsection B.2.2.6.6 of the Treasury Board Directive) | Unless delegated to the deputy head, ministerial approval is required | Section B.4 |

| Hospitality paid by the federal government extended at the residence of a public servant (subsection B.2.2.6.7 of the Treasury Board Directive) | Unless delegated to the deputy head, ministerial approval is required | Section B.4 |

| Private club membership | Unless delegated to the deputy head, ministerial approval is required | Subsection B.6.1 |

| Exceptional hospitality | Unless delegated to the deputy head, ministerial approval is required | Subsection B.6.5 |

| Who is receiving the hospitality? | Approval required | More information is provided in the following subsections |

|---|---|---|

| Public servants only: | ||

| Participation is required (beyond normal working hours, no nearby or appropriate facilities to obtain refreshments or meals, or staff dispersal is not effective or efficient) | Hospitality can be provided but should be on an exceptional basis | Subsection B.6.2 |

| Award and recognition ceremony | Hospitality approval and event approval are required | Subsection B.6.3 |

| No discretion in the provision of hospitality | Hospitality approval under Appendix B of the Treasury Board Directive does not apply | Subsection B.6.4 |

| Deputy head | Chief financial officer approval is required | Subsection B.6.6 |

Legend

- CFO:

- chief financial officer

- SDM:

- senior departmental manager

- Treasury Board Directive:

- Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures

B.2 Hospitality planning

Departments must try to avoid or minimize their use of hospitality and maintain rigorous management oversight over their hospitality expenditures. Departments need to carefully consider the decision to offer hospitality and must ensure that the hospitality is required for reasons of courtesy, diplomacy or protocol, or to facilitate the achievement of the business of the government, as set out in subsection B.2.2.1 of the Treasury Board Directive.

Departments may find it useful to establish a hospitality plan to streamline the approval process when multiple hospitality activities require approval by the same delegated authority.

To maximize efficiencies in the approval process, departments should coordinate hospitality approvals with event approvals.

B.3 Hospitality approval authority

Subsection B.2.2 of the Treasury Board Directive sets out the approval authority for hospitality expenditures.

Approval authority thresholds are summarized in Table 4. To determine the approval authority based on threshold, the total cost for the hospitality needs to be calculated. These costs include, as applicable, meals and beverage costs, elements listed under subsection B.2.2.5 of the Treasury Board Directive and exceptional hospitality under subsection B.5.5 of this guide.

| Approval authority | Threshold |

|---|---|

| Minister | Greater than $10,000 |

| Deputy head | Greater than $3,000 and up to and including $10,000 |

| Senior departmental manager or delegate | $3,000 or less |

Notwithstanding the above hospitality approval thresholds, when a hospitality activity includes components under subsection B.2.2.6 of the Treasury Board Directive, ministerial approval is required unless delegated to the deputy head as per subsection B.2.2.6 of the Treasury Board Directive.

If food and beverages are provided as part of hospitality, the cost should not normally exceed the standard cost per person. Unless approval authority is delegated to the deputy head, the appropriate minister is the approval authority for exceptional circumstances where it is anticipated that the standard cost per person in subsection B.2.2.2.1 of the Treasury Board Directive will be exceeded.

When calculating the cost per person of food and beverage, departments should include all related costs, such as the service delivery charges, gratuities and applicable taxes.

An amended approval at the appropriate delegated authority level is required if there are significant changes to the originally approved nature or extent of hospitality before an activity. It is up to individual departments to define “significant” in the context of their organization. Departments are expected to monitor actual expenses against planned costs and to minimize variances.

Hospitality expenditures are to be coded under hospitality for reporting purposes (see subsection B.7 of this guide for more information).

B.4 Delegation of hospitality approval authority

Subsection B.2.2.6 of the Treasury Board Directive sets out the hospitality components where ministerial approval is required. Appropriate ministers may choose to delegate to the deputy head some or all the hospitality components listed in that subsection. The deputy head cannot sub-delegate the approval of these hospitality components.

B.5 Blanket hospitality authority

According to the Treasury Board Directive, blanket hospitality authority (BHA) is authorization for hospitality which is continuous or repetitive in nature and where it is not practical or administratively efficient to obtain prior approval for each individual hospitality occurrence.

BHAs cannot include any of the hospitality components that require ministerial approval in accordance with subsection B.2.2.6 of the Treasury Board Directive.

Subsection B.2.2.11 of the Treasury Board Directive provides the authority for the use of BHAs. Approval of BHAs depends on the components included in the BHA. Chief financial officers (CFOs) should ensure that the approval of BHAs is formally documented and reviewed at least once a year. A BHA cannot be carried over to the next fiscal year.

When obtaining approval for a BHA, the following information should be provided:

- the nature of hospitality that can be offered, ensuring that it excludes those hospitality components and any related limitations, listed in subsection B.2.2.6 of the Treasury Board Directive

- the estimated number of hospitality events during the fiscal year

- the estimated cost and the maximum cost of each hospitality event

- the types of possible participants (for example, public servants or non-public servants)

- the estimated number of participants for each hospitality event

- the period in the fiscal year when the BHA will apply

The approval authority level for a BHA is based on the estimated hospitality costs per hospitality activity, not the total amount of the BHA. The approval of BHAs depends on the departmental delegation chart of spending and financial authorities.

A new approval should be obtained if there are any substantive changes to the above information.

Costs covered under a BHA that are related to an event must be considered when calculating total event costs for event approval. To maximize efficiencies, hospitality and event approvals can be combined.

BHAs are considered a higher-risk business process, so departments must have proper controls and oversight in place. The controls over BHAs are part of the department’s system of internal controls over financial management.

B.6 Treatment of specific types of hospitality

B.6.1 Private club membership

Departments are not permitted to purchase memberships in private clubs, either in the name of the department or an individual.

As per subsection B.2.2.13 of the Treasury Board Directive, a minister has the authority to approve on an exceptional basis the purchase of a membership in a private club. This authority can only be delegated to the deputy head.

Private club membership does not include membership in a professional body, for example, the Chartered Professional Accountants of Canada, the Canadian Medical Association or the Canadian Bar Association.

B.6.2 Situations where only public servants are present

In situations where only public servants are present, hospitality should be provided only on an exceptional basis. Subsection B.2.2.3 of the Treasury Board Directive states that when only public servants are present, hospitality can only be provided in situations where participation is required in operational meetings, training or events that extend beyond normal working hours, including where there are no nearby or appropriate facilities to obtain refreshments or meals, or staff dispersal is not effective or efficient. “Beyond normal working hours” includes situations where public servants are required to work through normal break and meal periods.

B.6.3 Award and recognition ceremonies for public servants

Paragraph 12(1)(b) of the Financial Administration Act provides deputy heads with the authority to provide awards to employees. Hospitality provided as part of a related award and recognition ceremony to public servants should be provided only on an exceptional basis and should follow the hospitality approval process. Event approval is also required. The authority under paragraph 12(1)(b) of the Financial Administration Act does not provide authority for the reimbursement of expenses for companion travel (see subsection A.6.3 of this guide for information on approval of companion travel).

B.6.4 Situations where the department has no discretion in the provision of hospitality

Subsection B.2.2.4 of the Treasury Board Directive recognizes that in some circumstances, departments must provide meals to public servants. For example, when a collective agreement stipulates that meals must be provided to public servants in the course of their duties, no hospitality approval is required. In these circumstances, Appendix B of the Treasury Board Directive does not apply.

B.6.5 Exceptional hospitality

Approval from the appropriate minister is required for hospitality that is considered exceptional due to unusual circumstances and that is not covered under the ministerial approval authority in subsection B.2.2.6 of the Treasury Board Directive. Exceptional hospitality can be approved by the appropriate minister as long as it is deemed necessary for reasons of courtesy, diplomacy or protocol, or to facilitate the achievement of the business of the government in accordance with subsection B.2.2.1 of the Treasury Board Directive. Appropriate ministers may choose to delegate to the deputy head the approval of exceptional hospitality in accordance with subsection B.2.2.6 of the Treasury Board Directive. The deputy head cannot sub-delegate the approval of exceptional hospitality.

B.6.6 Situations where the individual who would normally approve hospitality also attends the event

Subsection B.2.2.9 of the Treasury Board Directive states that an appropriate alternative approval authority must be obtained when the individual who would normally approve the hospitality is also a participant at the hospitality event. Only ministers are exempted from this requirement. The alternative individual needs to have sufficient delegated approval authority.

Subsection B.2.2.10 of the Treasury Board Directive states that the CFO will be the approval authority for hospitality when the deputy head is in attendance at the event and where the deputy head would normally approve the hospitality. To avoid the perception that the deputy head is in conflict of interest, the CFO approves the hospitality up to the limits delegated to the deputy head, including when the CFO is also in attendance at the same hospitality event.

B.6.7 Coordination of approvals

To maximize efficiencies, if approval is required for an event and the event includes hospitality, then the event and hospitality should be approved together at the highest approval level.

For example, a department is organizing an event. The travel and other costs are low, but the food and beverage costs are above the standard cost per person in subsection B.2.2.2.1 of the Treasury Board Directive. Ministerial approval should therefore be sought for both hospitality and event expenditures, in accordance with subsection B.2.2.6.3 of the Treasury Board Directive.

Departments can determine how to coordinate event approvals. In cases where the CFO has approved hospitality because the deputy head is in attendance, the deputy head approves the event within the event approval authorities, as applicable.

B.7 Recording hospitality expenditures

Hospitality expenditures are recorded using economic object 0822 from the government-wide chart of accounts for Canada. Hospitality expenditures include elements listed under subsection B.2.2.5 of the Treasury Board Directive and exceptional hospitality under subsection B.5.5 of this guide.

In situations where public servants are required to attend an event organized by an external organization as official departmental representatives, any costs associated with such attendance (for example, tickets) should be recorded using economic object 0352 (public relations services) rather than economic object 0822 (hospitality). Attendance at such events must support departmental operational activities and be properly justified.

Appendix C: Conferences

C.1 Conference definition

According to the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures (the Treasury Board Directive), conferences are events and refer to a congress, convention, seminar, symposium or other formal gathering, which are usually organized by a third party external to government, where participants debate or are informed of the status of a discipline (for example, sciences, economics, technology, management).

C.2 Conference planning

Departments should plan the necessary departmental staff attendance and identify any additional required event or travel approval for expected upcoming conferences.

C.3 Conference approval authority

According to subsection C.2.2.3 of the Treasury Board Directive, conference approval authority is at the senior departmental manager level. The elements of the guiding principles described in section 3 of this guide should be considered by the senior departmental manager before exercising approval authority.

C.4 Types of conferences

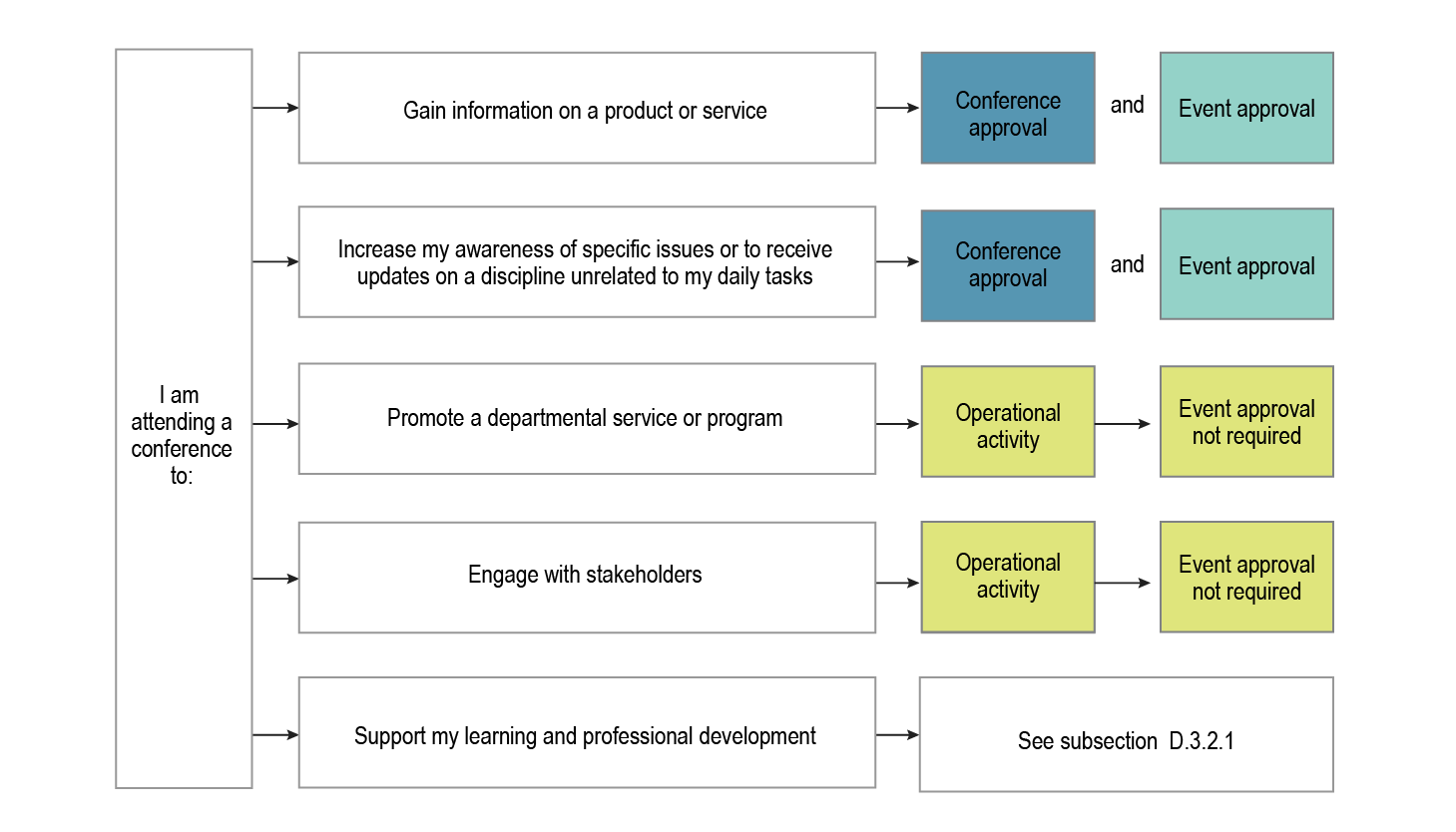

Figure 3 illustrates how the purpose for attending the conference determines the approval authority required.

Figure 3: Text version

This figure provides an overview of conference approval authority. It explains how the purpose for attending the conference determines the approval authority required.

If the purpose for attending the conference is to gain information on a product or service, conference approval and event approval are required.

If the purpose for attending the conference is to increase awareness of specific issues or to receive updates on a discipline unrelated to daily tasks, conference approval and event approval are required.

If the purpose for attending the conference is to promote a departmental service or program, attendance is considered an operational activity; therefore event approval is not required.

If the purpose for attending the conference is to engage with stakeholders, attendance is considered an operational activity; therefore event approval is not required.

If the purpose for attending the conference is to support learning and professional development, see subsection D.3.2.1.

C.4.1 Conference attendance to share information

Attendance at a conference to share recent developments on a product or service provided by a private organization or to increase awareness of a certain subject requires conference and event approval. For example, a conference that an employee attends to gather information on a product (such as a trade show) that the department is considering purchasing requires conference and event approval.

Attendance at a conference that is not necessary for the department to achieve its objectives requires conference and event approval. For example, a conference that an employee attends to increase his or her awareness of specific issues or to receive updates on a discipline unrelated to his or her daily tasks requires conference and event approval.

C.4.2 Conference attendance in support of departmental programs

There may be situations where attendance at a conference is required to help deliver the department’s programs or services, such as promoting a departmental program or service or engaging with stakeholders. In these situations, the attendance at the conference may be considered an operational activity; therefore, conference and event approval is not required. For example:

- a conference where an employee delivers a presentation or discusses with stakeholders the design of a departmental program could be considered an operational activity

- a student conference where human resources employees responsible for recruitment work at an information booth to promote careers in the Government of Canada could be considered an operational activity

C.4.3 Conference attendance in support of learning and professional development

Attendance at a large information-sharing or learning session for the purpose of learning or professional development (for example, fees for employees to participate in a large learning session to help them maintain or acquire skills or knowledge they need to perform their duties) may be considered training by the government-wide functional community leads. See subsection D.3.2.1 of this guide for more information.

C.5 Reporting of travel expenses related to conference attendance

Conference expenditures are to be recorded using object 0823 of the government-wide chart of accounts for Canada. See subsection G.3.3 of this guide for more information.

Travel costs for attendees of a conference should be recorded using the appropriate category of travel. The categories are listed in subsection A.7.3 of this guide.

Appendix D: Events

D.1 Introduction

According to the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures (the Treasury Board Directive), events involve gatherings of individuals (both public and non-public servants) engaged in activities other than operational activities of the department. Examples of events include, but are not limited to:

- management and staff retreats

- participation in conferences

- award and recognition ceremonies

- departmental celebrations

D.2 Event planning

To maximize efficiencies, approvals for travel, hospitality, conferences and events should be coordinated and submitted to the most senior approval authority. For example, coordinating approval of an event and a conference requires approval at no lower than the senior departmental manager level, because conference attendance must be approved at this level.

D.3 Determining whether event approval is required

Event approval is not required for operational activities (see subsection D.3.1 of this guide) or training (see subsection D.3.2 of this guide). For guidance on whether an event or a class of events requires event approval, delegated managers should contact their departmental financial policy group.

D.3.1 Operational activities

Operational activities do not require event approval. The Treasury Board Directive defines operational activities as those activities undertaken to deliver departmental programs and services, including departmental internal services. For individuals, operational activities are those activities undertaken in the performance of their assigned tasks, as set out in position descriptions, terms of reference, statements of work, or other similar documents. Any gathering of individuals whose purpose is not to conduct operational activities is to be defined as an “event.”

The chief financial officer (CFO) should ensure that the department has a process in place to support individuals who have delegated approval authority in making the distinction between operational activities and events.

The CFO is encouraged to confirm with the deputy head the desired treatment of certain approvals, including where discretion may be applied. Factors such as public perception, nature, scale or significance of an event, and ministerial expectations may all affect the determination of whether an activity should be classified as an operational activity or an event.

Figure 4 provides examples to illustrate when an activity could be considered an operational activity or an event.

Figure 4: Text version

This figure provides examples of operational and non-operational activities and whether event approval is required.

| Activity | Is this activity an operational activity? | Is event approval required? |

|---|---|---|

| Delivery of departmental programs or services (for example employees of the Canadian Food Inspection Agency performing food inspections) | Yes | No |

| Delivery of internal services that support the delivery of departmental programs or services (for example, internal audit) | Yes | No |

| Meetings to plan activities that support departmental programs or services, including internal services (for example, meetings to plan stakeholder consultations as part of the development or amendment of regulations) | Yes | No |

| Governance activities that are an essential part of departmental oversight (for example, Departmental Audit Committee meetings) | Yes | No |

| Meetings to brief staff or provide an update on key priorities (for example, staff meetings, staff retreats, management retreats) | No | Yes |

| Activities to recognize teams or employees (for example, departmental celebrations and award and recognition ceremonies) | No | Yes |

D.3.2 Training

Training activities are not considered events. They should be approved according to the established departmental processes for training, such as the delegated spending and financial authorities or the delegation of human resources authorities. They should also form part of an individual’s annual training plan, as described in subsection D.2.2.2 of the Treasury Board Directive.

D.3.2.1 Conference versus training: large information-sharing or learning sessions

What are large information-sharing or learning sessions?

Large information-sharing or learning sessions are conferences that may support an individual’s learning and professional development or provide information on the status of a subject. These sessions have a large number of participants and may include participants from the public sector and private sector. These sessions do not include traditional forms of training, such as courses offered by the Canada School of Public Service, a university or other post-secondary institutions. Each large information-sharing or learning session is to be assessed on a case-by-case basis to determine whether it is to be considered as a conference or as training for approval purposes.

What is the role of government-wide functional community leads?

The government-wide functional community leads at the Treasury Board of Canada Secretariat (as described in Table 5) will objectively determine, on a case-by-case basis, whether large information-sharing or learning sessions are to be considered conferences or training.

For example, the Comptroller General of Canada will make decisions on the treatment of large information-sharing or learning sessions for the financial management function. The financial management function could include several occupational groups, for example, Financial Management (FI) and Administrative Services (AS) involved in the financial management function.

| Government-wide functional community lead | Function |

|---|---|

| Comptroller General of Canada | Financial management, internal audit, real property, material management, procurement and project management |

| Chief Information Officer of the Government of Canada | Information management, information technology and security |

| Chief Human Resources Officer | People management and executives |

| Departmental deputy head (not a government-wide functional community lead) | Other communities where there is no government-wide functional community lead, such as research, health services, legal services, applied science, economics and social science services, etc. |

How do government-wide functional community leads communicate decisions about the designation of a large information-sharing or learning session?

When the government-wide functional community lead has made a decision about the designation of a large information-sharing or learning session, the information will be posted on the GCpedia page (accessible only on the Government of Canada network).

CFOs and departmental heads of human resources are responsible for regularly reviewing the GCpedia page (accessible only on the Government of Canada network) to ensure that the appropriate approvals for the large information-sharing or learning sessions are obtained for their departmental staff.

What if there is no government-wide functional community lead?

If there is no government-wide functional community lead, the deputy head will decide how large information-sharing or learning sessions will be treated for their staff. It is recommended that departments maintain a list of conferences for which an internal decision has been made and make it available within their department.

What approvals are required?

If the large information-sharing or learning session is designated as a conference, then conference approval and event approval are required.

If the large information-sharing or learning session is designated as training, then conference approval and event approval are not required.

- Training approval is to be obtained through the established departmental processes as described in subsection D.3.2 of this guide.

- Ideally before the conference, the CFO should provide the deputy head with a report for information purposes (not for approval) on the total departmental costs and number of participants when the total cost of the conference (including associated costs, such as travel) exceeds $50,000.

Figure 5 shows the process to determine which approval is required for a large information-sharing or learning session.

Figure 5: Text version

This figure provides an overview of the approval process for large information-sharing or learning sessions. It illustrates the difference in the process for decisions made by the government-wide functional community lead and the deputy head (when there is no government-wide functional community lead).

Approvals process when there is a government-wide functional community lead

If the government-wide functional community lead has designated a large information-sharing or learning session as training, training approval is required.

If the government-wide functional community lead has not yet designated a session as training or a conference, he or she is asked to make a decision. If the government-wide functional community lead decides that the large information-sharing or learning session is training, training approval is required. If the functional community lead decides that the session is a conference, conference approval and event approval are required.

Approvals process when there is no government-wide functional community lead

If there is no government-wide functional community lead, the departmental process should be followed; for example, consulting a list of sessions that the deputy head has designated as training or conferences. If the deputy head decides to designate a session as training, training approval is required. If the deputy head decides to designate a session as a conference, conference approval and event approval are required.

D.3.3 Recording of large information-sharing or learning session expenses

To ensure consistent government-wide coding, all travel expenses incurred to attend a large information-sharing or learning session should be coded to the appropriate economic object code, as described in Table 3 of Appendix A of this guide.

If a large information-sharing or learning session is designated as a conference, then the expenses should be recorded using economic object 0823.

If a large information-sharing or learning session is designated as training, then the expenses should be recorded using economic object 0447.

D.3.4 Summary of when event approval authority is required for training, conferences and events

Table 6 shows the distinction between training, conferences and events and outlines when event approval is required.

| Expenditure type | Description | Event approval required? |

|---|---|---|

| Training | Fees paid for formal learning activities, which include a curriculum and established learning objectives, and where the primary purpose is to enable participants to maintain or acquire skills or knowledge. | No |

| Conference | Are events and refer to a congress, convention, seminar, symposium or other formal gathering, which are usually organized by a third party external to government, where participants debate or are informed of the status of a discipline (for example, sciences, economics, technology, management). | Yes, unless a large information-sharing or learning session is deemed to be training. |

| Event | Involves gatherings of individuals (may be both public and non-public servants) engaged in activities other than operational activities of the department. | Yes |

D.4 Determining and monitoring event expenditures

To determine the approval required in accordance with the event approval thresholds in Table 7, the total cost for the event needs to be calculated.

| Approval authority | Threshold |

|---|---|

| Minister | Greater than $50,000 |

| Deputy head | Greater than $25,000 and up to and including $50,000 |

| Senior departmental manager or delegate | $25,000 or less |

The calculation of the total departmental costs for a single event should include the following:

- conferences fees

- professional services charges

- hospitality

- accommodation

- transportation

- meals while travelling

- taxes, gratuities and service charges

- costs incurred by the appropriate minister or the appropriate minister’s staff for activities related to a department’s programs that are charged to the department’s budget

- other relevant costs directly attributable to the event

These costs exclude salary costs and other departmental fixed operating costs that are part of the department’s ongoing operations.

When upfront costs for a major event are being paid by a department but the reimbursement of some costs will be sought from other departments or external participants, the event approval authority will be determined in accordance with the total costs of the event before any reimbursement. The planned reimbursements should, however, be disclosed to the event approval authority.

According to subsection D.2.2.4 of the Treasury Board Directive, the CFO must ensure that the appropriate minister is provided with the total estimated federal cost for all participating departments, including the total estimated travel costs, for information purposes, when their approval is required for an event hosted by the department. Each department participating in the event must obtain its own travel and event approvals, as appropriate.

Departments are expected to monitor actual event costs against planned event costs to minimize cost increases. An updated approval should be obtained if there is a significant increase in costs for an upcoming event.

Appendix E: Approvals and planning for taxes

To determine the level of approval authority for travel, hospitality, conferences and events, the Goods and Services Tax / Harmonized Sales Tax (GST/HST) and the Quebec Sales Tax (QST) should be included in the total for planning and approval purposes. For the recording of the GST/HST and QST incurred for actual expenses, departments should charge these taxes to the GST/HST Refundable Advance Account or the QST Refundable Advance Account, respectively.

In general, provincial sales tax (PST), except for QST, is not payable on federal government purchases. However, if employees use personal funds or their individual designated travel card to pay for items such as meals, taxis, vehicle rentals and hotel accommodations, which will then be reimbursed to the employee, PST will be charged and, therefore, should be included in the total for planning and approval purposes. For the recording of the PST paid as part of reimbursements to employees, departments should charge these amounts to the departmental operating vote.

Appendix F: Transparency of travel, hospitality and conference expenditures

F.1 Proactive publication of travel and hospitality expenses

As per the Access to Information Act, heads of government institutions are responsible for the proactive publication of travel and hospitality expenses of senior officers or employees. Institutions can refer to the Guide to the Proactive Publication of Travel and Hospitality Expenses for guidance on the proactive publication of travel and hospitality expenses.

F.2 Disclosure of travel receipts

Receipts supporting travel claims of senior officers or employees may be disclosed, with appropriate redactions to protect personal information, when they are requested under the Access to Information Act.

F.3 Reporting annual travel, hospitality and conference expenditures

Departments must annually disclose their total travel, hospitality and conference expenditures, in accordance with subsection 4.1.2 of the Treasury Board Directive. Total travel expenditures must be reported by travel categories, in accordance with subsection A.2.2.14 of the Treasury Board Directive and explanations be provided for main variances from the previous year per travel categories. See appendices G to I of this guide for additional information.

Appendix G: Template and guidance for annual report on travel, hospitality and conference expenditures

G.1 Introduction

This template and guidance are issued to support chief financial officers (CFOs) in planning and preparing their department’s annual report on travel, hospitality and conference (THC) expenditures. This report does not include event expenditures. The following sections outline the expected content and format of the report. Compliance with this template and guidance will ensure consistency and minimize effort across government in reporting to the public on THC expenditures.

Subsection 4.1.2 of the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures (the Treasury Board Directive) requires that departments disclose the total annual expenditures for each of travel, hospitality and conference fees. They must also indicate the main variances from the previous year’s actual expenditures. This disclosure is to coincide with the tabling of the Departmental Results Report.

Departments should post their annual report on THC expenditures on the Government of Canada website open.canada.ca for centralized access.

G.2 Content of the Annual Report on Travel, Hospitality and Conference Expenditures

The objective of the annual report on THC expenditures is to provide the following:

- the department’s total annual expenditures for each of travel, hospitality and conferences

- information on how the expenditures were incurred in respect of the department’s mandate and business objectives

- a brief explanation of significant variances in expenditures from the previous year, except in the case of the first annual report for new departments (see Appendix H of this guide)

In previous years, annual reports on THC expenditures reported on travel expenditures based on whether the travel was by public servants or by non-public servants. In accordance with subsection A.2.2.14 of the Treasury Board Directive, departments must provide the total expenditures for public servants and non-public servants for each travel category, starting for the 2017–18 fiscal year.

Comparative information must be provided for each travel category, and variance explanations must be provided for variances from the previous year’s total travel expenditures. Departments do not have to restate their travel expenditures for the year ended March 31, 2017, by travel category. See Appendices H and I of this guide for reporting templates.

Departments will also provide the total international travel expenditures for their minister and minister’s staff when those expenditures are charged to their departmental budget as part of a departmental program (where applicable).These expenditures are included in the expenditures for specific travel categories and are reported separately under international travel by minister and minister’s staff. See the Policy for Ministers’ Offices for guidance on travel expenditures for ministers and minister’s staff.

New departments will not provide data for the previous year. Comparison with the previous year and related variance explanations will commence only with a new department’s second annual report. Departments that have undergone major organizational changes should contact the Office of the Comptroller General for specific guidance on reporting.

Appendices H and I of this guide provide templates for the first annual report and for the second and subsequent annual reports on THC expenditures, respectively.

G.3 Categories of expenditures

G.3.1 Travel

Travel expenditures include the following expenses of public servants and non-public servants, including when a travel agency invoices a department for the following expenses:

- transportation of people by air, rail, sea, bus, taxi, air taxi and tolls

- meals, incidentals and accommodation services such as hotels, motels, corporate residences, apartments, private non-commercial accommodation, and government and institutional accommodation

Travel expenditures are to be recorded using the five categories of travel listed in Table 3 of Appendix A of this guide.

G.3.2 Hospitality expenditures

Hospitality expenditures refer to amounts paid for the provision of hospitality to individuals under the Treasury Board Directive and hospitality governed by other authorities such as Global Affairs Canada’s Official Hospitality Outside Canada policy and the Heads of Post and Foreign Service Official Hospitality directives. Hospitality expenditures are to be recorded using object 0822 of the government-wide chart of accounts for Canada.

G.3.3 Conference expenditures

Conference expenditures refer to fees paid to attend a conference, congress, convention, briefing seminar or other formal gathering in one location where participants debate or are informed of the status of a discipline (for example, science, economics, technology or management).

Conference expenditures do not include amounts paid for the following:

- attending an event for the primary purpose of acquiring training to maintain or acquire skills or knowledge (object 0447)

- travelling to attend a conference (objects 0251 to 0265)

- hosting a conference (for example, facility rental, hospitality, equipment rental)

- attending retreats and work-planning meetings

Conference expenditures are to be recorded using object 0823 of the government-wide chart of accounts for Canada.

Appendix H: Template for first annual report (new department)

Annual Report on Travel, Hospitality and Conference Expenditures

[Name of department]

[This template provides generic text that should be included in the report.]

As required by the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures, this report provides information on travel, hospitality and conference expenditures for [name of department] for the fiscal year ended March 31, YYYY.

Travel, hospitality and conference expenditures incurred by a federal department or agency relate to activities that support the department or agency’s mandate and the government’s priorities.

[Name of department]’s travel, hospitality and conference expenditures support the delivery of the following core programs and services to Canadians:

- [describe, in a few sentences, the department’s mandate, major programs and linkages with core laws or regulations to help readers understand the travel, hospitality and conference expenditures incurred by the department and how they support the department’s mandate.]

- [to avoid duplication of information, include hyperlinks to sections of the department’s Departmental Plan, Departmental Results Report, or other sources of relevant public information]

Travel, Hospitality and Conference Expenditures

[Name of department]

Year ended March 31, YYYY

| Expenditure category | Expenditures ($ thousands) |

|---|---|

| Total [A+B+C] | $ |

| International travel by minister and minister’s staff (included in Total travel) | $ |

| Travel | |

| Operational activities | $ |

| Key stakeholders | $ |

| Internal governance | $ |

| Training | $ |

| Other | $ |

| A. Total travel | $ |

| B. Hospitality | $ |

| C. Conference fees | $ |

Note [if applicable]: This is a [new/reorganized] department; therefore, no comparison with the previous year is provided.

Appendix I: Template for second and subsequent annual reports

Annual Report on Travel, Hospitality and Conference Expenditures

[Name of department]

[This template provides generic text that should be included in the report.]

As required by the Treasury Board Directive on Travel, Hospitality, Conference and Event Expenditures, this report provides information on travel, hospitality and conference expenditures for [name of department] for the fiscal year ended March 31, YYYY.

Travel, hospitality and conference expenditures incurred by a federal department or agency relate to activities that support the department or agency’s mandate and the government’s priorities.

[Name of department]’s travel, hospitality and conference expenditures support the delivery of the following core programs and services to Canadians:

- [describe, in a few sentences, the department’s mandate, major programs and linkages with core laws or regulations to help readers understand the travel, hospitality and conference expenditures incurred by the department and how they support the department’s mandate]

- [to avoid duplication of information, include hyperlinks to sections of the department’s Departmental Plan, Departmental Results Report or other sources of relevant public information]

- [mention significant structural or program changes (for example, new programs or initiatives, increased program budgets, mergers with other departments, or sunsetting of programs) if there is a direct relationship to variances from the previous year’s expenditures]

Travel, Hospitality and Conference Expenditures

[Name of department]

Year ended March 31, YYYY

| Expenditure category | Expenditures for year ended March 31, YYYY ($ thousands) [current year] | Expenditures for year ended March 31, YYYY ($ thousands) [previous year] | Variance ($ thousands) |

|---|---|---|---|

| Total [A+B+C] | $ | $ | $ |

| International travel by minister and minister’s staff (included in Total travel) | $ | $ | $ |

| Travel | |||

| Operational activities | $ | $ | $ |

| Key stakeholders | $ | $ | $ |

| Internal governance | $ | $ | $ |

| Training | $ | $ | $ |

| Other | $ | $ | $ |

| A. Total travel | $ | $ | $ |

| B. Hospitality | $ | $ | $ |

| C. Conference fees | $ | $ | $ |

Significant variances compared with previous fiscal year

[Where applicable, briefly explain significant variances from the previous year’s expenditures for each category.]

Travel: compared with fiscal year YYYY–YY, departmental travel expenditures for [specify the expenditure category] [increased/decreased] mainly due to [briefly explain the main reason(s) for the increase or decrease].

Hospitality: compared with fiscal year YYYY–YY, departmental hospitality expenditures [increased/decreased] mainly due to [briefly explain the main reason(s) for the increase or decrease].

Conference fees: compared with fiscal year YYYY–YY, departmental conference fee expenditures [increased/decreased] mainly due to [briefly explain the main reason(s) for the increase or decrease].

Minister and minister’s exempt staff: compared with fiscal year YYYY–YY, departmental expenditures for international travel by the Minister and the Minister’s exempt staff [increased/decreased] mainly due to [briefly explain the main reason(s) for the increase or decrease].

© His Majesty the King in Right of Canada, represented by the President of the Treasury Board, 2017,

ISBN: 978-0-660-23637-7