Common menu bar links

Breadcrumb Trail

ARCHIVED - Royal Canadian Mounted Police

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

Section III: Supplementary Information

Our Structure for Service / Program Delivery

The RCMP is organized under the authority of the RCMP Act. In accordance with the Act, it is headed by the Commissioner, who, under the general direction of the Minister of Public Safety (Public Safety and Emergency Preparedness), has the control and management of the Force and all matters connected therewith.

Key components of our management structure include:

- Deputy Commissioners Pacific, North West and Atlantic Regions: To oversee operations in these regions

- Deputy Commissioner Federal Services and Central Region: To meet our federal policing mandate [includes Federal and International Operations (FIO) and Protective Policing Services] as well as A, C and O Division operations

- Deputy Commissioner Operations and Integration: To drive horizontal integration in all areas including strategy, performance improvement and operations [includes National Security Criminal Investigations (NCSI), Criminal Intelligence (CI), Operational Readiness and Response Coordination Centre (ORRCC), Strategic Policy and Planning Directorate (SPPD), Integrated Operations Support (IOS) and Community, Contract and Aboriginal Policing Services (CCAPS)]

- Deputy Commissioner National Police Services: To focus on the provision of frontline operational services and information management to the RCMP and broader law enforcement and criminal justice communities [includes Technical Operations, the Canadian Police College (CPC), Canadian Police Information Centre (CPIC), Criminal Intelligence Service Canada (CISC), Forensic Laboratory Services (FLS), Information & Identification Services (I&IS), the National Child Exploitation Coordination Centre (NCECC), the Chief Information Officer (CIO) Sector, and the Canada Firearms Centre (CAFC). Specific details on the CAFC are included in a special chapter at the end of this report. FLS and I&IS were amalgamated in 2006 to form Forensic Science & Identification Services.]

- Deputy Commissioner Corporate Management and Comptrollership: To continue to meet standards of accountability, stewardship, results and value-based management, increased transparency and responsiveness, risk management, renewed control systems and sustainable development

- Deputy Commissioner Human Resources: To develop HR management strategies that maximize human performance and drive organizational success, ensure that HR policies and processes enable operational readiness, and build and sustain a workforce that is committed to excellence in service delivery.

In addition to the Deputy Commissioners, the Ethics and Integrity Advisor, the Director of Legal Services and the Chief Audit Executive (Observer Status) complete the Senior Executive Team.

To deliver on our responsibilities, we have over 25,000 employees including Regular and Civilian Members and Public Service employees. We are also fortunate to have over 75,000 volunteers to assist us in our efforts to deliver quality services to the communities we serve across Canada.

The RCMP is unique in the world since we are a national, federal, provincial and municipal policing body, and as a result, the men and women of the RCMP can be found all across Canada.

Operating from more than 750 detachments, we provide: daily policing services in over 200 municipalities; provincial or territorial policing services everywhere but Ontario and Quebec; and services to over 600 Aboriginal communities, four international airports, plus numerous smaller ones.

We are organized into four regions, 14 divisions, National Headquarters in Ottawa and the RCMP’s training facility – or “Depot” – in Regina. Each division is managed by a Commanding Officer and is alphabetically designated. Divisions roughly approximate provincial boundaries with their headquarters located in respective provincial or territorial capitals (except “A”, Ottawa; “C”, Montreal; “E”, Vancouver; and “O”, London).

Financial Tables

Table 1: Comparison of Planned to Actual Spending (including FTEs)

| Program Activity ($ millions) |

2004-2005 Actual |

2005-2006 Actual |

2006-2007 | |||

| Main Estimates | Planned Spending | Total Authorities | Actual | |||

| Federal and International Operations | 548.2 | 579.7 | 592.9 | 703.0 | 653.9 | 626.0 |

| Protective Policing Services | 120.0 | 125.7 | 105.1 | 116.4 | 150.7 | 108.9 |

| Community, Contract and Aboriginal Policing | 1,871.0 | 1,991.8 | 2,083.4 | 2,174.0 | 2,240.4 | 2,140.7 |

| Criminal Intelligence Operations | 68.7 | 71.6 | 70.3 | 76.5 | 85.2 | 81.8 |

| Technical Policing Operations | 171.0 | 168.8 | 174.2 | 189.3 | 198.3 | 190.8 |

| Policing Support Services | 60.7 | 67.3 | 68.5 | 71.1 | 80.0 | 84.0 |

| National Police Services | 143.5 | 161.9 | 149.7 | 164.8 | 210.4 | 170.9 |

|

Registration, Licensing and |

92.8 | 68.5 | 78.3 | 68.9 | 77.7 | 74.2 |

|

Policy, Regulatory, Communications |

5.3 | 4.7 | 4.8 | 2.4 | ||

|

Pensions under the RCMP |

22.6 | 23.6 | 23.0 | 23.0 | 20.4 | 20.4 |

|

To compensate members of the |

31.8 | 39.1 | 48.8 | 48.8 | 58.8 | 55.1 |

|

Payments in nature of Workers’ |

1.5 | 1.4 | 1.5 | 1.5 | 1.5 | 2.0 |

|

Pensions to families of members |

0.1 | 0.1 | 0.1 | 0.1 | 0.1 | 0.1 |

|

Total |

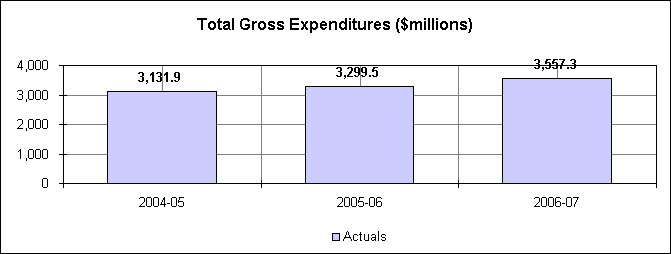

3,131.9 | 3,299.5 | 3,401.3 | 3,642.0 | 3,782.2 | 3,557.3 |

|

Less: Non-Respendable Revenue |

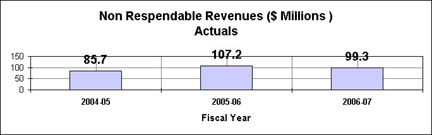

85.7 | 107.2 | 92.1 | 92.1 | 93.5 | 99.3 |

|

Plus: Cost of services received |

193.9 | 201.9 | 198.4 | 198.4 | 202.7 | 221.5 |

|

Net Cost of Department |

3,240.1 | 3,394.2 | 3,507.6 | 3,748.3 | 3,891.4 | 3,679.4 |

| Full Time Equivalents | 23,236.0 | 23,578.8 | 25,665.0 | 26,481.3 | 25,809.6 | 24,786.4 |

Note: Due to rounding, figures may not add to totals shown.

17.2 million”Refunds of amounts to revenues in previous years” shown in the 2006-2007 Public Accounts are not included.

Table 2: Use of Resources by Business Lines

| Program Activity ($ millions) |

Budgetary ($ millions) | |||||||

|

FTEs

|

Operating

|

Capital

|

Grants and Contributions

|

Total Gross Expenditures

|

Less:

Respendable Revenues |

Total

Net Expenditures |

||

| Federal and International Operations |

Main Estimates | 4,624.0 | 557.0 | 35.9 | 0.0 | 592.9 | 0.6 | 592.3 |

| (Planned) | 5,257.2 |

664.4 | 38.5 | 0.0 | 703.0 | 0.6 | 702.3 | |

| (Authorities) | 4,638.0 |

612.0 | 41.8 | 0.0 | 653.9 | 8.9 | 644.9 | |

| (Actual) | 4,224.9 | 585.7 | 40.4 | 0.0 | 626.0 | 7.7 | 618.3 | |

| Protective Policing Services | Main Estimates | 918.0 | 99.8 | 5.3 | 0.0 | 105.1 | 0.1 | 105.0 |

| (Planned) | 920.5 | 111.1 | 5.3 | 0.0 | 116.4 | 0.1 | 116.3 | |

| (Authorities) | 932.1 | 144.2 | 6.5 | 0.0 | 150.7 | 2.0 | 148.7 | |

| (Actual) | 595.6 | 102.0 | 6.9 | 0.0 | 108.9 | 5.4 | 103.5 | |

| Community, Contract and Aboriginal Policing |

Main Estimates | 15,945.0 |

1,899.2 | 184.2 | 0.0 | 2,083.4 | 1,235.2 | 848.2 |

| (Planned) | 5,983.7 | 1,989.8 | 184.2 | 0.0 | 2,174.0 | 1,235.2 | 938.8 | |

| (Authorities) | 15,946.2 | 2,038.3 | 202.1 | 0.0 | 2,240.4 | 1,313.7 | 926.7 | |

| (Actual) | 15,741.6 | 1,989.6 | 151.0 | 0.0 | 2,140.7 | 1,252.1 | 888.6 | |

| Criminal Intelligence Operations | Main Estimates |

587.0 |

66.8 | 3.5 | 0.0 | 70.3 | 0.1 | 70.2 |

| (Planned) | 624.2 | 73.0 | 3.5 | 0.0 | 76.5 | 0.1 | 76.4 | |

| (Authorities) | 596.0 | 80.8 | 4.3 | 0.0 | 85.2 | 1.0 | 84.2 | |

| (Actual) | 596.6 | 79.1 | 2.6 | 0.0 | 81.8 | 0.9 | 80.9 | |

| Technical Policing Operations | Main Estimates |

1,333.0 |

155.3 | 18.9 | 0.0 | 174.2 | 0.2 | 173.9 |

| (Planned) | 1,432.4 | 170.3 | 18.9 | 0.0 | 189.3 | 0.2 | 189.0 | |

| (Authorities) | 1,333.1 | 176.3 | 22.0 | 0.0 | 198.3 | 3.5 | 194.9 | |

| (Actual) | 1,389.6 | 180.1 | 10.7 | 0.0 | 190.8 | 2.1 | 188.7 | |

| Policing Support Services | Main Estimates |

402.0 |

65.9 | 2.6 | 0.0 | 68.5 | 0.1 | 68.4 |

| (Planned) | 403.2 | 68.4 | 2.6 | 0.0 | 71.1 | 0.1 | 71.0 | |

| (Authorities) | 402.0 | 76.8 | 3.2 | 0.0 | 80.0 | 1.0 | 79.0 | |

| (Actual) | 528.1 | 79.2 | 4.8 | 0.0 | 84.0 | 0.9 | 83.2 | |

| National Police Services | Main Estimates | 1,454.0 | 138.8 | 10.5 | 0.4 | 149.7 | 3.7 | 146.0 |

| (Planned) | 1,458.1 | 153.9 | 10.5 | 0.4 | 164.8 | 3.7 | 161.2 | |

| (Authorities) | 1,560.1 | 197.4 | 12.6 | 0.4 | 210.4 | 6.0 | 204.4 | |

| (Actual) | 1,353.0 | 161.6 | 8.9 | 0.4 | 170.9 | 7.8 | 163.1 | |

| Registration, Licensing and Supporting Infrastructure | Main Estimates | 375.0 | 65.3 | 0.0 | 13.0 | 78.3 | 0.0 | 78.3 |

| (Planned) | 375.0 | 55.9 | 0.0 | 13.0 | 68.9 | 0.0 | 68.9 | |

| (Authorities) | 375.0 | 64.7 | 0.0 | 13.0 | 77.7 | 0.0 | 77.7 | |

| (Actual) | 339.0 | 63.1 | 0.0 | 11.1 | 74.2 | 0.0 | 74.2 | |

| Policy, Regulatory, Communications and Portfolio Integration | Main Estimates |

27.0 |

4.3 | 0.0 | 1.0 | 5.3 | 0.0 | 5.3 |

| (Planned) | 27.0 | 3.7 | 0.0 | 1.0 | 4.7 | 0.0 | 4.7 | |

| (Authorities) | 27.0 | 3.8 | 0.0 | 1.0 | 4.8 | 0.0 | 4.8 | |

| (Actual) | 18.0 | 2.2 | 0.0 | 0.2 | 2.4 | 0.0 | 2.4 | |

| Pensions under the RCMP Contribution Act | Main Estimates |

0.0 |

0.0 | 0.0 | 23.0 | 23.0 | 0.0 | 23.0 |

| (Planned) | 0.0 | 0.0 | 0.0 | 23.0 | 23.0 | 0.0 | 23.0 | |

| (Authorities) | 0.0 | 0.0 | 0.0 | 20.4 | 20.4 | 0.0 | 20.4 | |

| (Actual) | 0.0 | 0.0 | 0.0 | 20.4 | 20.4 | 0.0 | 20.4 | |

| To compensate members of the RCMP for injuries received in the performance of duty | Main Estimates |

0.0 |

0.0 | 0.0 | 48.8 | 48.8 | 0.0 | 48.8 |

| (Planned) | 0.0 | 0.0 | 0.0 | 48.8 | 48.8 | 0.0 | 48.8 | |

| (Authorities) | 0.0 | 0.0 | 0.0 | 58.8 | 58.8 | 0.0 | 58.8 | |

| (Actual) | 0.0 | 0.0 | 0.0 | 55.1 | 55.1 | 0.0 | 55.1 | |

| Payments in nature of Workers’ Compensation, to survivors of members of the Force | Main Estimates |

0.0 |

0.0 | 0.0 | 1.5 | 1.5 | 0.0 | 1.5 |

| (Planned) | 0.0 | 0.0 | 0.0 | 1.5 | 1.5 | 0.0 | 1.5 | |

| (Authorities) | 0.0 | 0.0 | 0.0 | 1.5 | 1.5 | 0.0 | 1.5 | |

| (Actual) | 0.0 | 0.0 | 0.0 | 2.0 | 2.0 | 0.0 | 2.0 | |

| Pensions to families of members of the RCMP who have lost their lives while on duty | Main Estimates |

0.0 |

0.0 | 0.0 | 0.1 | 0.1 | 0.0 | 0.1 |

| (Planned) | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | 0.0 | 0.1 | |

| (Authorities) | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | 0.0 | 0.1 | |

| (Actual) | 0.0 | 0.0 | 0.0 | 0.1 | 0.1 | 0.0 | 0.1 | |

| Total | Main Estimates | 25,665.0 | 3,052.4 | 261.1 | 87.9 | 3,401.3 | 1,240.0 | 2,161.3 |

| (Planned) | 26,481.3 | 3,290.6 | 263.7 | 87.8 | 3,642.1 | 1,240.0 | 2,402.1 | |

| (Authorities) | 25,809.6 | 3,394.4 | 292.6 | 95.2 | 3,782.2 | 1,336.0 | 2,446.2 | |

| (Actual) | 24,786.4 | 3,242.6 | 225.4 | 89.3 | 3,557.3 | 1,276.8 | 2,280.5 | |

|

Note: Due to rounding, figures may not add to totals shown. |

||||||||

Table 3: Voted and Statutory Items

| Financial Requirements by Authority ($ millions) | |||||

|

Vote |

Royal Canadian Mounted Police Law Enforcement Program

|

2006-2007 | |||

|

Main Estimates

|

Planned Spending

|

Total Authorities

|

Actual

|

||

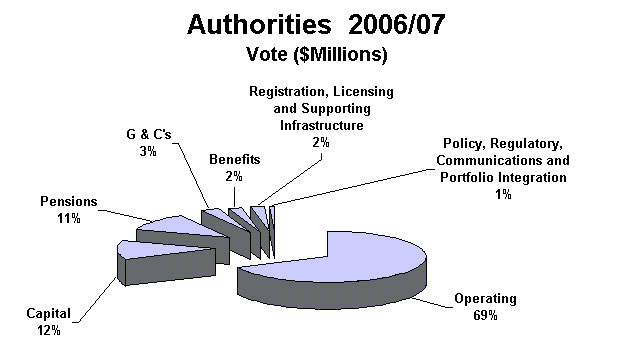

| 60 | Operating expenditures | 1,259.0 | 1,313.0 | 1,656.3 | 1,570.4 |

| 61 | Registration, Licensing and Supporting Infrastructure |

50.8 | 50.8 | 51.6 | 50.6 |

| 62 | Policy, Regulatory, Communications and Portfolio Integration |

14.6 | 14.6 | 14.0 | 11.7 |

| 65 | Capital expenditures | 197.9 | 217.0 | 292.6 |

225.4 |

| 70 | Grants and Contributions | 43.7 | 43.7 | 74.9 | 68.8 |

| (S) | Pensions and other employee benefits – Members of the Force | 288.6 | 288.6 | 270.5 | 270.5 |

| (S) | Contributions to employee benefit plans | 51.1 | 51.1 | 58.5 | 58.5 |

| (S) | Pensions under the Royal Canadian Mounted Police Pension Continuation Act | 23.0 | 23.0 | 20.4 | 20.4 |

| Total Department | 1,928.7 | 2,001.8 | 2,438.8 | 2,276.3 | |

|

Note: Total authorities are main estimates plus supplementary estimates plus other authorities. |

|||||

Table 4: Services Received Without Charge

| ($ millions) | 2006-2007 |

| Accommodation provided by Public Works and Government Services Canada (PWGSC) | 60.6 |

| Contributions covering employers' share of employees' insurance premiums and expenditures paid by TBS | 158.1 |

| Worker's compensation coverage provided by Social Development Canada | 0.4 |

| Salary and associated expenditures of legal services provided by Justice Canada | 2.4 |

| Total 2006-2007 Services Received without charge | 221.5 |

| Note: Due to rounding, figures may not add to totals shown. |

Table 5: Loans, Investments and Advances (Non-budgetary)

NIL reply. No activity for the fiscal period in review.

Table 6: Sources of Respendable and Non-Respendable Revenue

| Revenues by Business Line ($ millions) | ||||||

| Respendable Revenues* | 2006-2007 | |||||

| Program Activity | Actual 2004-2005 |

Actual 2005-2006 |

Main Estimates |

Planned Revenue |

Total Authorities |

Actual |

| Federal and International Operations | 6.1 | 6.8 | 0.6 | 0.6 | 8.9 | 7.7 |

| Protective Policing Services | 1.4 | 1.5 | 0.1 | 0.1 | 2.0 | 5.4 |

| Community, Contract and Aboriginal Policing | 1,065.2 | 1,167.1 | 1,235.2 | 1,235.2 | 1,313.7 | 1,252.1 |

| Criminal Intelligence Operations | 0.7 | 0.8 | 0.1 | 0.1 | 1.0 | 0.9 |

| Technical Policing Operations | 2.4 | 1.9 | 0.2 | 0.2 | 3.5 | 2.1 |

| Policing Support Services | 0.7 | 0.8 | 0.1 | 0.1 | 1.0 | 0.9 |

| National Policing Services | 10.5 | 6.8 | 3.7 | 3.7 | 6.0 | 7.8 |

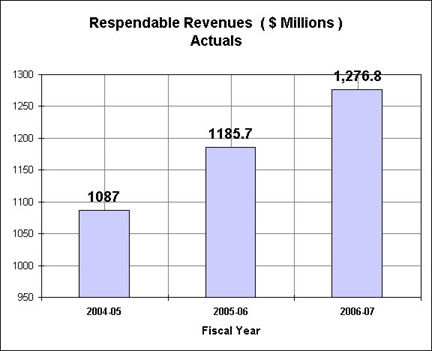

| Total Respendable Revenues | 1,087.0 | 1,185.7 | 1,240.0 | 1,240.0 | 1,336.0 | 1,276.8 |

| Non-Respendable Revenues |

2006-2007 |

|||||

| Program Activity | Actual 2004-2005 |

Actual 2005-2006 |

Main Estimates |

Planned Revenue |

Total Authorities |

Actual |

| Privileges, Licences and permits | 20.1 | 29.1 | 12.4 | 12.4 | 12.4 | 17.5 |

| Refund of Prior Years' Expenditures | 3.5 | 3.9 | 6.1 | 6.1 | 6.1 | 5.4 |

| Return On Investments | 0.0 | 0.0 | 0.1 | 0.1 | 0.1 | 0.0 |

| Miscellaneous | 54.4 | 68.3 | 65.7 | 65.7 | 65.7 | 70.9 |

| Proceeds for Sales | 1.6 | 1.4 | 2.0 | 2.0 | 2.0 | 0.9 |

| Proceeds from Asset Disposal | 6.1 | 4.5 | 5.8 | 5.8 | 7.2 | 4.6 |

| Total Non-Respendable Revenues | 85.7 | 107.2 | 92.1 | 92.1 | 93.5 | 99.3 |

| Total Revenues | 1,172.7 | 1,292.9 | 1,332.1 | 1,332.1 | 1,429.5 | 1,376.1 |

|

Note: *Respendable revenues are primarily generated by the provision of policing services under contract to provinces, territories and municipalities. Other revenues related to payment for courses and accommodation at the Canadian Police College and for technology. |

||||||

Table 7: Revolving Fundse (Statements of Operations, Statement of Cash Flows and Projected Use of Authority)

NIL reply. No activity for the fiscal period in review.

Table 8: Resource Requirements by Branch/Sector Level

| ($ millions) | Federal and International Operations | Protective Policing Services | Community, Contract and Aboriginal Policing | Criminal Intelligence Operations | Technical Policing Operations | Policing Support Services | National Policing Services | Registration, Licensing and Support Infrastructure | Policy, Regulatory, Communications and Portfolio Integration | Total Respendable Revenue |

| Atlantic Region | ||||||||||

| Planned Spending |

48.2

|

2.2

|

94.5

|

4.5

|

9.9

|

0.7

|

2.4

|

0.0

|

0.0

|

162.5

|

| Actual Spending |

55.1

|

3.6

|

112.3

|

4.0

|

13.9

|

0.9

|

2.9

|

0.0

|

0.0

|

192.6

|

| Central Region | ||||||||||

| Planned Spending |

251.7

|

17.4

|

35.8

|

22.7

|

37.6

|

1.1

|

5.0

|

0.0

|

0.0

|

371.4

|

| Actual Spending |

272.2

|

30.9

|

43.2

|

33.0

|

45.8

|

1.4

|

5.8

|

0.0

|

0.0

|

432.4

|

| North West Region | ||||||||||

| Planned Spending |

66.0

|

3.8

|

184.1

|

11.0

|

18.8

|

1.2

|

3.2

|

0.0

|

0.0

|

288.1

|

| Actual Spending |

72.9

|

5.1

|

244.3

|

9.5

|

23.0

|

1.7

|

4.8

|

0.0

|

0.0

|

361.2

|

| Pacific Region | ||||||||||

| Planned Spending |

77.2

|

6.2

|

161.1

|

12.2

|

22.5

|

0.9

|

3.1

|

0.0

|

0.0

|

283.2

|

| Actual Spending |

91.0

|

17.2

|

263.9

|

12.1

|

27.0

|

1.4

|

4.3

|

0.0

|

0.0

|

416.9

|

|

National Headquarters |

||||||||||

| Planned Spending |

144.9

|

66.0

|

246.9

|

19.8

|

85.1

|

57.0

|

132.5

|

68.3

|

5.3

|

825.9

|

| Actual Spending |

127.2

|

46.7

|

224.8

|

22.3

|

78.9

|

77.8

|

145.3

|

90.4

|

3.4

|

816.9

|

|

Total |

||||||||||

| Planned Spending |

588.0

|

95.6

|

722.5

|

70.2

|

173.9

|

61.0

|

146.3

|

68.3

|

5.3

|

1,931.1

|

| Actual Spending |

618.3

|

103.5

|

888.6

|

80.9

|

188.7

|

83.2

|

163.1

|

90.4

|

3.4

|

2,220.1

|

Note: 77.6 million Unallocated Grants and Contributions are not included in the numbers stated above

Program Activity allocations may represent all related activities undertaken across RCMP Divisions and do not necessarily reflect allocations for a specific RCMP program, service or organizational unit of similar name.

Planned Spending based on Main Estimates

Actual Spending based on Main Estimates + in-year funding

Table 9–A: 2006-2007 User Fee Reporting Template – User Fees Act

Royal Canadian Mounted Police

| A. User Fee | Fees charged for the processing of access requests filed under the Access to Information Act | ||

| Fee Type | Regulatory | ||

| Fee Setting Authority | Access to Information Act | ||

| Date Last Modified | 1992 | ||

| Forecast Revenue ($ millions) 0.0 |

Actual Revenue ($ millions) 0.0 |

Full Cost ($ millions) 3.25 |

|

| 2006-2007 | Performance Standard |

Framework developed by TBS. |

|

| 2006-2007 | Performance Results |

Access to Information Act |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 0.0 |

| Fiscal Year 2008-09 | 0.0 | ||

| Fiscal Year 2009-10 | 0.0 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | 3.53 |

| Fiscal Year 2008-09 | 3.70 | ||

| Fiscal Year 2009-10 | 3.70 | ||

Canada Firearms Centre

| A. User Fee | Fees charged for the processing of access requests filed under the Access to Information Act | ||

| Fee Type | Other Products and Services | ||

| Fee Setting Authority | Access to Information Act | ||

| Date Last Modified | 1992 | ||

| Forecast Revenue ($ millions) 0.0 |

Actual Revenue ($ millions) 0.0 |

Full Cost ($ millions) 0.2 |

|

| 2006-2007 | Performance Standard |

Framework developed by TBS. |

|

| 2006-2007 | Performance Results |

Access to Information Act |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 0.0 |

| Fiscal Year 2008-09 | 0.0 | ||

| Fiscal Year 2009-10 | 0.0 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | 0.2 |

| Fiscal Year 2008-09 | 0.2 | ||

| Fiscal Year 2009-10 | 0.2 | ||

Canada Firearms Centre

| A. User Fee | Business Licences | ||

| Fee Type | Regulatory | ||

| Fee Setting Authority | Firearms Fees Regulations | ||

| Date Last Modified | April 10, 2005 | ||

| Forecast Revenue ($ millions) 0.6 |

Actual Revenue ($ millions) 0.5 |

Full Cost ($ millions) Section C Other information See note (1) |

|

| 2006-2007 | Performance Standard |

Section C – Other information – See note (2) |

|

| 2006-2007 | Performance Results |

Section C – Other information – See note (3) |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 0.1 |

| Fiscal Year 2008-09 | 0.6 | ||

| Fiscal Year 2009-10 | 0.6 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | Section C – Other information – See note (1) |

| Fiscal Year 2008-09 | |||

| Fiscal Year 2009-10 | |||

| A. User Fee | Individual Licences | ||

| Fee Type | Regulatory | ||

| Fee Setting Authority | Firearms Fees Regulations | ||

| Date Last Modified | December 1, 1998 | ||

| Forecast Revenue ($ millions) 1.9 |

Actual Revenue |

Full Cost ($ millions) Section C Other information See note (1) |

|

| 2006-2007 | Performance Standard |

45 days |

|

| 2006-2007 | Performance Results |

76% of properly completed individual licence applications were completed within 45 days |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 1.9 |

| Fiscal Year 2008-09 | 21.7 | ||

| Fiscal Year 2009-10 | 21.7 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | Section C – Other information – See note (1) |

| Fiscal Year 2008-09 | |||

| Fiscal Year 2009-10 | |||

Canada Firearms Centre

| A. User Fee | Registration Certificates | ||

| Fee Type | Regulatory | ||

| Fee Setting Authority | Firearms Fees Regulations | ||

| Date Last Modified | Registration fees repealed as of May 20, 2004 | ||

| Forecast Revenue ($ millions) 0.0 |

Actual Revenue |

Full Cost ($ millions) Section C Other information See note (1) |

|

| 2006-2007 | Performance Standard |

30 days |

|

| 2006-2007 | Performance Results |

63% of properly completed registration applications were completed within 30 days |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 0.0 |

| Fiscal Year 2008-09 | 0.0 | ||

| Fiscal Year 2009-10 | 0.0 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | Section C – Other information – See note (1) |

| Fiscal Year 2008-09 | |||

| Fiscal Year 2009-10 | |||

Canada Firearms Centre

| A. User Fee | Authorizations | ||

| Fee Type | Regulatory | ||

| Fee Setting Authority | Firearms Fees Regulations | ||

| Date Last Modified | December 1, 1998 | ||

| Forecast Revenue ($ millions) 0.3 |

Actual Revenue |

Full Cost ($ millions) Section C Other information See note (1) |

|

| 2006-2007 | Performance Standard |

Section C – Other information – See note (2) |

|

| 2006-2007 | Performance Results |

Section C – Other information – See note (3) |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 0.3 |

| Fiscal Year 2008-09 | 0.3 | ||

| Fiscal Year 2009-10 | 0.3 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | Section C – Other information – See note (1) |

| Fiscal Year 2008-09 | |||

| Fiscal Year 2009-10 | |||

Canada Firearms Centre

| A. User Fee | Non-resident Permits | ||

| Fee Type | Regulatory | ||

| Fee Setting Authority | Firearms Fees Regulations | ||

| Date Last Modified | April 10, 2005 | ||

| Forecast Revenue ($ millions) 1.9 |

Actual Revenue |

Full Cost ($ millions) Section C Other information See note (1) |

|

| 2006-2007 | Performance Standard |

Section C – Other information – See note (2) |

|

| 2006-2007 | Performance Results |

Section C – Other information – See note (3) |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 1.9 |

| Fiscal Year 2008-09 | 1.9 | ||

| Fiscal Year 2009-10 | 1.9 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | Section C – Other information – See note (1) |

| Fiscal Year 2008-09 | |||

| Fiscal Year 2009-10 | |||

Canada Firearms Centre

| A. User Fee | Services for replacement of documents | ||

| Fee Type | Regulatory | ||

| Fee Setting Authority | Firearms Fees Regulations | ||

| Date Last Modified | April 10, 2005 | ||

| Forecast Revenue ($ millions) 0.1 |

Actual Revenue |

Full Cost ($ millions) Section C Other information See note (1) |

|

| 2006-2007 | Performance Standard |

Section C – Other information – See note (2) |

|

| 2006-2007 | Performance Results |

Section C – Other information – See note (3) |

|

| Planning Years | Forecast Revenue ($ millions) |

Fiscal Year 2007-08 | 0.1 |

| Fiscal Year 2008-09 | 0.1 | ||

| Fiscal Year 2009-10 | 0.1 | ||

| Planning Years | Estimated Full Cost ($ millions) |

Fiscal Year 2007-08 | Section C – Other information – See note (1) |

| Fiscal Year 2008-09 | |||

| Fiscal Year 2009-10 | |||

Canada Firearms Centre

|

2006-2007

|

Planning Years

|

||||||

|

($ millions)

|

Forecast

Revenue |

Actual

Revenue |

Full

Cost |

2007-2008

|

2008-2009

|

2009-2010

|

|

| Business Licences |

0.6

|

0.5

|

–

|

0.1

|

0.6

|

0.6

|

|

| Individual Licences |

1.9

|

4.9

|

–

|

1.9

|

21.7

|

21.7

|

|

| Registration Certificates |

0.0

|

0.0

|

–

|

0.0

|

0.0

|

0.0

|

|

| Authorizations |

0.3

|

0.3

|

–

|

0.3

|

0.3

|

0.3

|

|

| Non-resident Permits |

1.9

|

2.0

|

–

|

1.9

|

1.9

|

1.9

|

|

| Services for replacement of documents |

0.1

|

0.1

|

–

|

0.1

|

0.1

|

0.1

|

|

| Total |

4.8

|

7.8

|

–

|

4.3

|

24.6

|

24.6

|

|

B. Date Last Modified:

Forecast Revenues:

- On May 17, 2006, the Government announced individuals no longer have to pay the fee for the renewal of their possession-only licence (POL) or their possession and acquisition licence (PAL). The fee waiver also applies to:

- individuals who are modifying their licence to upgrade from a POL to a PAL

- individuals who are adding new privileges to their licence

- individuals whose licence expired 1 and are obtaining a new licence; and

- minors who renew their minors’ possession licence.

- Fees for registration of firearms were repealed May 20, 2004.

- Forecast and actual revenue for fees charged for the processing of access requests filed under the Access to Information Act is approximately $2,000 per year as per the Annual Report to Parliament (2004-2005) – Access to Information Act and Privacy Act. For more information, please refer to the CAFC website.

Note: 1 If the expired licence was a possession-only licence, the licence is no longer valid. To continue to possess firearms, an individual must meet safety training requirements and apply for a possession and acquisition licence).

Table 10: Progress Against the Department’s Regulatory Plan

Nil reply. No activity for the fiscal period in review.

Table 12: Status Report on Major Crown Projects

Real Time Identification (RTID)

1. Overview

Real Time Identification (RTID) is a re-engineering of systems and processes used for fingerprint identification, civil clearances and criminal records maintenance. It will transform the current paper-based workflow to an electronic workflow, enabling the “real time” identification of fingerprints submitted electronically.

Fingerprints are submitted by police agencies to support the creation of a criminal record, or to search the criminal record repository during a criminal investigation or civil security screening. RTID will streamline these services, facilitate information sharing internationally, and permit an improved tracking of criminals by condensing identification turnaround times from weeks and months to hours and days.

Funding for the RTID Project was announced on April 20, 2004, under the National Security Policy. Between 2001 and 2004 significant work had already been undertaken by a small project team within the RCMP to define RTID requirements and prepare statements of work in anticipation of this announcement.

Following the announcement, a Project Charter was developed and a formal Project Office established under the sponsorship of Information and Identification Services of National Police Services (NPS). The Chief Information Officer (CIO) was appointed Project Leader, responsible for achieving the technology improvements associated with the project. The Project Director reports to the CIO.

The project will be delivered in two major Phases. Phase 1 will modernize the civil clearance process, replace the Automated Fingerprint Identification System (AFIS) and implement a new transaction manager, the NPS National Institute of Standards and Technology (NIST) Server, permitting agencies to submit their fingerprint information electronically. Phase 1 is being delivered in different releases in 2007.

Phase 2 will modernize the processes related to the management and update of the criminal records. Phase 2 is a large re-engineering effort and the replacement of antiquated legacy systems in support of the re-engineering effort. Phase 2 will be delivered in Spring 2009.

2. Lead and Participating Departments

The RCMP is the lead department on RTID. Various levels of governance will ensure the Project is successful and meets the needs of all stakeholders.

The Senior Project Advisory Committee is a senior level committee of RCMP, Public Safety Canada (PS) and Central Agency officials that advises the Project Leader on all aspects of the project as it relates to government-wide policies, strategic direction and procurement, including the review of the scope through the definition stage, and the procurement strategy for the project.

An RTID Project Steering Committee provides ongoing direction to the project, and includes representatives of key Federal Government departments and Central Agencies. Oversight of RTID is also linked to existing PS committees, such as the PS Portfolio Interoperability Committee, thus ensuring the project’s horizontal interests and planned contribution to overall public safety are fully realized.

RTID is a major interoperability initiative of interest to all agencies within the PS portfolio. Its progress and success in contributing to long-term interoperability will be monitored by the Heads of Agency Steering Committee through the Portfolio Interoperability Committee.

RTID will be used across Canada and in all jurisdiction levels. Stakeholder involvement is required to ensure that the system is useful for all and does not hinder or contravene regulations for any. This involvement is ensured through the NPS Advisory Council and Technical Consultative working groups.

3. Prime Contractors / Major Sub-Contractors

The RCMP is using several procurement vehicles for the RTID Project:

1. Automated Fingerprint Identification System (AFIS) Vendor: RTID involves the replacement of the existing AFIS with modern AFIS technology. The AFIS vendor, COGENT Systems, selected via a competitive process, is responsible for the delivery, configuration and implementation of a modern AFIS commercial off-the-shelf (COTS) product.

2. Development work that aligns with the RCMP corporate technical architecture is being carried out in-house. The NPS NIST Server, the heart of RTID, is being developed by a team of RCMP resources and contractors. To supplement the skills of internal resources, or to backfill resources seconded to the project, RTID uses internal standing offer vehicles to meet any outstanding demand for project management support, systems architecture and engineering support, systems design, systems development, testing, training and implementation. The major contractors are:

- Veritaaq

- NRNS

- Fujitsu

- TPG

3. Systems Integration Company: a component of Phase 2 will be contracted out on a fixed price basis to ensure the successful delivery of the multiple components that make up that phase. A Request for Proposal (RFP) has been issued and proposals are due in mid-September 2007. Contract award is anticipated by mid-December 2007.

4. Major Milestones

Accomplishments

- Funding for RTID was announced on April 20, 2004 under the National Security Policy

- The current procurement approach was approved by the Senior Project Advisory Committee in November 2004

- On December 13, 2004, the RCMP received Treasury Board approval of its RTID procurement strategy and Preliminary Project Approval at an indicative estimate of $129.8 million to complete development of RTID over 5 years. The source of funds was identified as follows: $99.8 million from Canada’s National Security Policy and $30 million from RCMP funding

- A Request for Proposal for the AFIS Vendor was issued in January 2005. A contract was awarded to COGENT Systems on October 13, 2005 and work started November 1, 2005

- On October 3, 2005, Effective Project Approval for Phase 1 was awarded by TB to the RTID project

- In November 2006, the RTID Project successfully implemented its first release (R0.5) to bring on two civil contributors

- In March 2007, the RTID Project successfully implemented a subsequent release (R1.0) providing more functionality to the civil fingerprint process

- On June 14, 2007, Effective Project Approval for Phase 2 was awarded by Treasury Board to the RTID project

- RFP’s for Phase 2 were published in June 2007

To be delivered

- Complete delivery of Phase 1 is planned for December 2007

- Delivery of Phase 2 is planned for Spring 2009

- Project closure is on March 31, 2009

5. Progress Report and Explanation of Variances

Phase 1 work has been split into multiple releases to make the implementation of functionality more successful. The multiple release schedules are now tracking for complete delivery by December 2007. Phase 2 re-engineering started in January 2006, as planned, and completed in the Spring 2007. The RFP has been prepared and published in June 2007, with a contract award expected in December 2007.

6. Industrial Benefits

There is no industrial benefits program for the Real Time Identification Project.

Note: For specific information concerning CAFC Major Crown Projects, please see Section V.

Table 14: Conditional Grants (Foundations)

NIL reply. No activity for the fiscal period in review.

Table 15: Financial Statements (unaudited)

of Royal Canadian Mounted Police

For the year ended

March 31, 2007

Statement of Management Responsibility

Responsibility for the integrity and objectivity of the accompanying financial statements for the year ended March 31, 2007 and all information contained in these statements rests with the management of the Royal Canadian Mounted Police (RCMP). These financial statements have been prepared by management in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the RCMP’s financial transactions. Financial information submitted to the Public Accounts of Canada and included in the RCMP’s Departmental Performance Report is consistent with these financial statements.

Management maintains a system of financial management and internal control designed to provide reasonable assurance that financial information is reliable, that assets are safeguarded and that transactions are in accordance with the Financial Administration Act, are executed in accordance with prescribed regulations, within Parliamentary authorities, and are properly recorded to maintain accountability of Government funds. Management also seeks to ensure the objectivity and integrity of data in its financial statements by careful selection, training and development of qualified staff, by organizational arrangements that provide appropriate divisions of responsibility, and by communication programs aimed at ensuring that regulations, policies, standards and managerial authorities are understood throughout the RCMP.

The financial statements of the RCMP have not been audited.

|

William J.S. Elliott, Commissioner |

Alain P. S�guin, Acting Deputy Commissioner Corporate Management & Comptrollership |

Ottawa, Canada

August 9, 2007

Statement of Operations (unaudited)

For the year ended March 31

(in thousands of dollars)

| 2007 | 2006 | |

| EXPENSES (note 4) | ||

| Community, Contract and Aboriginal Policing | 2,245,564 | 2,098,768 |

| Federal & International Policing | 648,497 | 606,898 |

| Technical Policing Operations | 204,446 | 190,839 |

| National Police Services | 183,421 | 174,450 |

| Protective Policing Services | 116,024 | 134,681 |

| Criminal Intelligence Operations | 85,920 | 75,496 |

| Policing Support Services | 85,742 | 71,354 |

| Firearms Registration, Licensing and Supporting Infrastructure | 84,192 | 101,467 |

| Other activities | 80,231 | 70,800 |

| Total expenses | 3,734,037 | 3,524,753 |

| REVENUES (note 5) | ||

| Community, Contract and Aboriginal Policing | 1,347,642 | 1,312,206 |

| National Police Services | 15,545 | 11,474 |

| Other activities | 34,569 | 1,679 |

| Total revenues | 1,397,756 | 1,325,359 |

| NET COST OF OPERATIONS | 2,336,281 | 2,199,394 |

| The accompanying notes form an integral part of these financial statements. | ||

Statement of Financial Position (unaudited)

For the year ended March 31

(in thousands of dollars)

| 2007 | 2006 | |

| ASSETS |

Restated

(note 17) |

|

| Financial assets | ||

| Accounts receivables and advances (note 6) | 364,510 | 512,825 |

|

Total financial assets |

364,510 | 512,825 |

| Non-financial assets | ||

| Spare parts, materials and supplies | 36,917 | 37,927 |

| Prepaid expenses | – | 831 |

| Tangible capital assets (note 7) | 1,103,518 | 1,037,979 |

|

Total non-financial assets |

1,140,435 | 1,076,737 |

| Total | 1,504,945 | 1,589,562 |

| LIABILITIES | ||

| Accounts payable and accrued liabilities (note 8) | 307,983 | 270,302 |

| Vacation pay and compensatory leave | 185,431 | 183,388 |

| RCMP Pension Accounts (note 9) | 11,703,416 | 11,322,814 |

| Deferred revenue (note 10) | 103,753 | 75,528 |

| Employee severance benefits (note 11) | 439,453 | 424,744 |

| Other liabilities (note 12) | 8,419 | 6,579 |

|

Total liabilities |

12,748,455 | 12,283,355 |

| Equity of Canada | (11,243,510) | (10,693,793) |

| Total | 1,504,945 | 1,589,562 |

| Contingent liabilities (note 13) | ||

| Contractual obligations (note 14) | ||

| The accompanying notes form an integral part of these financial statements. | ||

Statement of Equity (unaudited)

For the year ended March 31

(in thousands of dollars)

| 2007 |

2006 |

|

| Equity of Canada, beginning of year | 10,693,793 | 10,357,565 |

| Net cost of operations | 2,336,281 | 2,199,394 |

| Current year appropriations used (note 3) | (2,297,710) | (2,115,936) |

| Revenue not available for spending | 124,488 | 159,089 |

| Refund of prior year expenditures | 7,737 | 6,365 |

| Change in net position in the Consolidated Revenue Fund (note 3) | 600,376 | 289,171 |

| Service provided without charge by other government departments (note 15) | (221,455) | (201,855) |

| Equity of Canada, end of year | 11,243,510 | 10,693,793 |

| The accompanying notes form an integral part of these financial statements. | ||

Statement of Cash Flow (unaudited)

For the year ended March 31

(in thousands of dollars)

| 2007 | 2006 Restated (note 17) |

|

| OPERATING ACTIVITIES | ||

| Net Cost of Operations | 2,336,281 | 2,199,394 |

| Non-cash items | ||

|

Amortization of tangible capital assets |

(125,580) | (112,199) |

|

Loss on disposal of assets |

(11,716) | (879) |

|

Loss on write-off |

(4,260) | (46,559) |

|

Service provided without charge from other government departments |

(221,455) | (201,855) |

| Variations in Statement of Financial Position | ||

|

(Decrease) Increase in financial assets |

(148,315) | 20,198 |

|

Decrease in spare parts, material & supplies |

(1,010) | (7,828) |

|

(Decrease) Increase in prepaid expense |

(831) | 227 |

|

(Increase) in liabilities |

(465,100) | (366,079) |

| Cash used by operating activities | 1,358,014 | 1,484,420 |

| CAPITAL INVESTMENT ACTIVITIES | ||

|

Acquisitions of tangible capital assets |

211,174 | 181,888 |

|

Proceeds from disposal or transfer of tangible capital assets |

(4,079) | (4,997) |

| Cash used by capital investment activities | 207,095 | 176,891 |

| FINANCING ACTIVITIES | ||

| Net Cash Provided by Government | 1,565,109 | 1,661,311 |

| The accompanying notes form an integral part of these financial statements. | ||

ROYAL CANADIAN MOUNTED POLICE

Notes for Financial Statements (Unaudited)

For the year ended March 31, 2007

1. Authority and Mandate

The Royal Canadian Mounted Police (RCMP) is Canada’s national police service and an agency of the Ministry of Public Safety and Emergency Preparedness.

The RCMP mandate is based on the authority and responsibility assigned under section 18 of the Royal Canadian Mounted Police Act. The mandate of the RCMP is to enforce laws, prevent crime, and maintain peace, order and security. Ten program activities highlight our Program Activity Architecture (PAA). These include:

- Community, Contract and Aboriginal Policing: Contributes to safe homes and safe communities by providing police services to diverse communities in eight provinces (with the exception of Ontario and Quebec) and three territories through cost-shared policing service agreements with federal, provincial, territorial, municipal and Aboriginal governments

- Federal and International Operations: Provides policing, law enforcement, investigative and protective services to the federal government, its departments and agencies and to Canadians

- Technical Policing Operations: Provides policy, advice and management to predict, research, develop and ensure the availability of technical tools and expertise to enable frontline members and partners to prevent and investigate crime and enforce the law, protect against terrorism, and operate in a safe and secure environment

- National Police Services: Contributes to safe homes and safe communities for Canadians through the acquisition, analysis, dissemination and warehousing of law enforcement-specific applications of science and technology to all accredited Canadian law enforcement agencies

- Protective Policing Services: Directs the planning, implementation, administration and monitoring of the RCMP’s national Protective Security Program, including the protection of dignitaries, the security of major events and Special Initiatives, including Prime Minister-led summits of an international nature

- Criminal Intelligence Operations: A national program for the management of criminal information and intelligence in the detection and prevention of crime of an organized, serious or national security nature in Canada or internationally as it affects Canada

- Policing Support Services: Services provided in support of the RCMP’s role as a police organization

- Firearms Registration, Licensing and Supporting Infrastructure: Develop and oversee an effective firearms registration and licensing system to meet the Government’s principle obligations under the Firearms Act. Enhance public safety by helping reduce death, injury and threat from firearms through responsible ownership, use and storage of firearms, and by providing police and other organizations with expertise and information vital to the prevention and investigation of firearms crime and misuse in Canada and internationally

- Corporate Infrastructure: Includes the vital administrative services required for an organization to operate effectively. The costs associated with this activity are distributed among the remaining program activities

- Firearms Policy, Regulatory, Communication and Portfolio Integration: Services provided in support of the RCMP’s role and activities of the Canada Firearms Center

2. Summary of Significant Accounting Policies

The financial statements have been prepared in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector.

(a) The RCMP is primarily financed by the Government of Canada through Parliamentary appropriations. Appropriations provided to the department do not parallel financial reporting according to generally accepted accounting principles since appropriations are primarily based on cash flow requirements. Consequently, items recognized in the statement of operations and in the statement of financial position are not necessarily the same as those provided through appropriations from Parliament. Note 3 provides a high-level reconciliation between the bases of reporting.

(b) The department operates within the Consolidated Revenue Fund (CRF), which is administered by the Receiver General for Canada. All cash received by the department is deposited to the CRF and all cash disbursements made by the department are paid from the CRF. The net cash provided by Government is the difference between all cash receipts and all cash disbursements including transactions between departments of the federal government.

(c) Change in net position in the Consolidated Revenue Fund is the difference between the net cash provided by Government and appropriations used in a year, excluding the amount of non respendable revenue recorded by the department. It results from timing differences between when a transaction affects appropriations and when it is processed through the CRF.

(d) Revenues are accounted for in the period in which the underlying transactions or events occurred that gave rise to the revenues. Revenues that have been received but not yet earned or not spent in accordance with any external restrictions are recorded as deferred revenues.

(e) Expenses are recorded when the underlying transaction or expense occurred subject to the following:

- Grants are recognized in the year in which payment is due or in which the recipient has met the eligibility criteria.

- Contributions are recognized in the year in which the recipient has met the eligibility criteria or fulfilled the terms of a contractual transfer agreement.

- Vacation pay and compensatory leave are expensed as the benefits accrue to employees under their respective terms of employment.

- Services provided without charge by other government departments for accommodation, the employer’s contribution to the health and dental insurance plans, worker’s compensation and legal services are recorded as operating expenses at their estimated cost.

(f) Employee future benefits:

- Pension benefits for Public Service employees: Eligible employees participate in the Public Service Pension Plan, a multi-employer administered by the Government of Canada. The department’s contributions to the Plan are charged to expenses in the year incurred and represent the total departmental obligation to the Plan. Current legislation does not require the department to make contributions for any actuarial deficiencies of the Plan.

- Pension benefits for RCMP member: The Government of Canada sponsors a variety of employee future benefits such as pension plans and disability benefits, which cover members of the RCMP. The department administers the pension benefits for members of the RCMP. The actuarial liability and related disclosures for these future benefits are presented in the financial statements of the Government of Canada. This differs from the accounting and disclosures of future benefits for RCMP presented in these financial statements whereby pension expense corresponds to the department’s annual contributions toward the cost of current service. In addition to its regular contributions, current legislation also requires the department to make contributions for actuarial deficiencies in the RCMP Pension Plan. These contributions are expensed in the year they are credited to the Plan. This accounting treatment corresponds to the funding provided to departments through Parliamentary appropriations.

- Severance benefits: Employees and RCMP members are entitled to severance benefits under labour contracts or conditions of employment. These benefits are accrued as employees render the services necessary to earn them. The obligation relating to the benefits earned by employees and RCMP members is calculated using information derived from the results of the actuarially determined liability for employee severance benefits for the Government as a whole.

(g) Receivables from external parties are stated at amounts expected to be ultimately realized; a provision is made for external receivables where recovery is considered uncertain.

(h) Contingent liabilities – Contingent liabilities are potential liabilities which may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded. If the likelihood is not determinable or an amount cannot be reasonably estimated, the contingency is disclosed in the notes to the financial statements.

(i) Environmental liabilities – Environmental liabilities reflect the estimated costs related to the management and remediation of environmentally contaminated sites. Based on management’s best estimates, a liability is accrued and an expense recorded when the contamination occurs or when the department becomes aware of the contamination and is obligated, or is likely to be obligated to incur such costs. If the likelihood of the department’s obligation to incur these costs is not determinable, or if an amount cannot be reasonably estimated, the costs are disclosed as contingent liabilities in the notes to the financial statements.

(j) Inventories – Spare parts, materials and supplies are inventories held for future program delivery and are not intended for re-sale. They are valued at cost. If they no longer have service potential, they are valued at the lower of cost or net realizable value.

(k) Foreign currency transactions – Transactions involving foreign currencies are translated into Canadian dollar equivalents using rates of exchange in effect at the time of those transactions. Monetary assets and liabilities denominated in foreign currencies are translated using exchange rates in effect on March 31st. Gains resulting from foreign currency transactions are included under Other revenue in note 5. Losses are included under Other operating expense in note 4.

(l) Tangible capital assets – All tangible capital assets and leasehold improvements having an initial cost of $10,000 or more are recorded at their acquisition cost. Capital assets do not include intangibles, works of art and historical treasures that have cultural, aesthetic or historical value, assets located on Indian Reserves and museum collections.

Amortization of capital assets is done on a straight-line basis over the estimated useful life of the capital asset as follows:

| Asset Class | Sub-asset Class | Amortization Period |

| Buildings | 20 to 30 years | |

| Works and Infrastructures | 20 years | |

| Machinery and Equipment | Machinery and Equipment | 5 to 15 years |

| Informatics – Hardware | 4 to 7 years | |

| Informatics – Software | 3 to 7 years | |

| Vehicles | Marine Transportation | 10 to 15 years |

| Air Transportation | 10 years | |

| Land Transportation (non-military) | 3 to 5 years | |

| Land Transportation (military) | 10 years | |

| Leasehold Improvements | Term of lease |

In the normal course of business, the RCMP constructs buildings and other assets as well as develops software. The associated costs are accumulated in Assets under Construction (AUC) until the asset is in use. No amortization is taken until the asset is put in use.

(m) Intellectual property such as licences, patents and copyrights are expensed in the period in which they are incurred.

(n) Measurement uncertainty – The preparation of these financial statements in accordance with Treasury Board accounting policies which are consistent with Canadian generally accepted accounting principles for the public sector requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses reported in the financial statements. At the time of preparation of these statements, management believes the estimates and assumptions to be reasonable. The most significant items where estimates are used are contingent liabilities, environmental liabilities, the liability for employee severance benefits and the useful life of tangible capital assets. Actual results could significantly differ from those estimated. Management’s estimates are reviewed periodically and, as adjustments become necessary, they are recorded in the financial statements in the year they become known.

3. Parliamentary Appropriations

The Department receives most of its funding through annual Parliamentary appropriations. Items recognized in the statement of operations and the statement of financial position in one year may be funded through Parliamentary appropriations in prior, current or future years. Accordingly, the Department has different net results of operations for the year on a government funding basis than on an

accrual accounting basis. The differences are reconciled in the following tables:

(a) Reconciliation of net cost of operations to current year appropriations used

|

|

2007 | 2006 Restated (note 17) |

|

(in thousands of dollars) |

||

|

NET COST OF OPERATIONS |

2,336,281 | 2,199,394 |

| Adjustments for items affecting net cost of operations but not affecting appropriations | ||

| Add (Less): | ||

|

Services provided without charge from other government departments |

(221,455) | (201,855) |

|

Revenue not available for spending |

124,488 | 159,089 |

|

Amortization of tangible capital assets |

(125,580) | (112,199) |

|

Refunds of prior year expenditures |

7,737 | 6,365 |

|

Increase in liability for severance benefits |

(14,709) | (26,905) |

|

Transfer cost to assets under construction |

128,072 | 108,063 |

|

Increase in liability for vacation pay and compensatory leave |

(2,043) | (13,542) |

|

Increase in liability for contaminated sites |

(1,203) | (1,227) |

|

Net loss and write-off on disposal of tangible capital assets |

(15,921) | (40,469) |

|

Other |

(1,282) | (33,575) |

| Subtotal | (121,896) | (156,255) |

| Adjustments for items not affecting net cost of operations but affecting Appropriations | ||

|

Add (Less): |

||

|

Acquisitions of tangible capital assets |

78,207 | 73,895 |

|

Accountable advances |

173 | – |

|

Inventory purchased |

5,776 | (1,325) |

|

Prepaid expenses |

(831) | 227 |

| Subtotal | 83,325 | 72,797 |

| Current year Appropriations Used | 2,297,710 | 2,115,936 |

(b) Appropriations provided and used

|

Appropriations Provided |

||

|

|

2007 | 2006 Restated (note 17) |

|

(in thousands of dollars) |

||

| Operating expenditures | 1,721,843 | 1,559,547 |

| Capital expenditures | 292,555 | 203,547 |

| Grants & Contributions | 74,846 | 57,646 |

| Statutory amount | 374,004 | 369,733 |

| Less: | ||

| Appropriations available for future years | (3,543) | (2,758) |

| Lapsed appropriations – Operating | (161,995) | (71,779) |

| Total | 2,297,710 | 2,115,936 |

(c) Reconciliation of net cash provided by Government to current year appropriations used

|

|

2007 | 2006 Restated (note 17) |

|

(in thousands of dollars) |

||

| Net cash provided by Government |

1,565,109

|

1,661,311 |

| Revenue not available for spending |

124,488

|

159,089

|

| Refund of prior year expenditures |

7,737

|

6,365

|

|

1,697,334

|

1,826,765

|

|

| Change in net position in the Consolidated Revenue Fund |

|

|

|

Variation in accounts receivable and advances |

148,315

|

(20,198)

|

|

Variation in inventory |

1,010

|

7,828

|

|

Variation in prepaid expenses |

831

|

(227)

|

|

Variation in accounts payable and accrued liabilities |

37,681

|

(16,112)

|

|

Variation in pension liabilities |

380,602

|

364,880

|

|

Variation in deferred revenue |

28,225

|

(25,272)

|

|

Variation in other liabilities |

1,840

|

2,312

|

|

Other adjustments |

1,872

|

(24,040)

|

|

600,376

|

289,171

|

|

| Current year appropriations used |

2,297,710

|

2,115,936

|

4. Expenses

The following table presents details of expenses by category:

|

|

2007 | 2006 Restated (note 17) |

|

|

(in thousands of dollars) |

|||

| Operating expenses: | Salaries & employee benefits | 2,471,754 | 2,357,399 |

| Professional & special services | 305,489 | 271,321 | |

| Travel & relocation | 152,530 | 136,487 | |

| Amortization | 125,580 | 112,199 | |

| Accommodation | 108,893 | 91,986 | |

| Utilities, material & supplies | 105,260 | 97,251 | |

| Purchased repairs & maintenance | 88,732 | 79,303 | |

| Telecommunications | 44,457 | 40,120 | |

| Rentals | 26,013 | 28,068 | |

| Loss on disposal and write-off | 16,157 | 51,843 | |

| Provision for severance benefits | 14,708 | 26,905 | |

| Information | 3,958 | 2,963 | |

| Other operating expenses |

186,605 | 159,442 | |

| Subtotal | 3,650,136 | 3,455,287 | |

| Transfer payments: | Compensatory grants to individuals | 72,261 | 58,705 |

| Transfers to other levels of Governments | 11,076 | 10,115 | |

| Payments to or on behalf of First Nations Organizations | 178 | 224 | |

| Other | 386 | 422 | |

| Subtotal | 83,901 | 69,466 | |

| TOTAL EXPENSES | 3,734,037 | 3,524,753 | |

5. Revenues

The following table presents details of revenues by category:

|

|

2007 | 2006 Restated (note 17) |

|

(in thousands of dollars) |

||

| Policing services | 1,381,340 | 1,318,459 |

| Firearms registration fees | 6,245 | 19,294 |

| Less: Reimbursements of fees due to remission order | – | (19,000) |

| Net Firearms registration fees | 6,245 | 294 |

| Other revenues | 10,171 | 6,606 |

| TOTAL REVENUES | 1,397,756 | 1,325,359 |

6. Accounts Receivables and Advances

|

|

2007 | 2006 Restated (note 17) |

|

(in thousands of dollars) |

||

| Other government departments | 23,280 | 220,851 |

| External parties | 331,168 | 281,525 |

| Less: allowance for doubtful accounts on external receivables | (293) | (291) |

| Net receivables from external parties | 330,875 | 281,234 |

| Total receivables | 354,155 | 502,085 |

| Temporary advances | 7,815 | 8,233 |

| Standing Advances | 2,540 | 2,507 |

| Total Advances | 10,355 | 10,740 |

| Total receivables and advances | 364,510 | 512,825 |

7. Tangible Capital Assets

|

Cost |

Accumulated Amortization |

|||||||||

| Opening Balance |

Acquisition | Disposal and Write-offs | Closing Balance | Opening Balance Restated (note 17) |

Amortization | Disposal and Write-offs | Closing Balance | Net Book 2007 |

Net Book 2006 |

|

| Land | 41,672 | 1,039 | 174 | 42,537 | - | - | - | - | 42,537 | 41,672 |

| Buildings | 723,953 | 43,734 | 3,747 | 763,950 | 325,907 | 29,512 | 2,577 | 325,842 | 411,108 | 398,046 |

| Works & Infrastructure |

4,736 | 8,511 | - | 13,247 | 720 | 610 | 1,330 | 11,917 | 4,016 | |

| Machinery & Equipment |

461,770 | 66,162 | 3,071 | 524,861 | 267,742 | 44,693 | 2,925 | 309,510 | 215,351 | 194,028 |

| Vehicles | 431,129 | 65,524 | 35,381 | 461,272 | 208,994 | 49,650 | 25,781 | 232,863 | 228,409 | 222,135 |

| Leasehold Improvements |

9,593 | 2,661 | - | 12,254 | 1,972 | 1,115 | 3,087 | 9,167 | 7,621 | |

| Assets Under Construction |

170,461 | 23,543 | 8,975 | 185,029 | - | - | - | - | 185,029 | 170,461 |

| Total | 1,843,314 | 211,174 | 51,338 | 2,003,150 | 805,335 | 125,580 | 31,283 | 899,632 | 1,103,518 | 1,037,979 |

Note: Amortization expense for the year ended March 31, 2007 is $125,580 (2006 – $112,199).

8. Accounts Payable and Accrued Liabilities

The following table presents the accounts payable and other accrued liabilities:

|

|

2007 | 2006 Restated (note 17) |

|

(in thousands of dollars) |

||

| Payables to other government departments | 21,769 | 21,080 |

| Payables to external parties | 243,984 | 206,168 |

| Accrued salaries and wages | 20,444 | 21,046 |

| Other | 21,786 | 22,008 |

| Total accounts payable & accrued liabilities | 307,983 | 270,302 |

9. RCMP Pension Accounts

The department maintains accounts to record the transactions pertaining to the RCMP Pension Plan, which comprises the RCMP Superannuation Account, the RCMP pension Fund Account, the Retirement Compensation Arrangement Account and the Dependents Pension Fund Account.These accounts record transactions such as contributions, benefit payments, interest credits, refundable taxes and actuarial debit and credit funding adjustments resulting from triennial reviewed and transfers to the Public Sector Investment Board.

The value of the liabilities reported in these financial statements for the RCMP Pension Plan accounts do not reflect the actuarial value of these liabilities determined by the Chief Actuary of the Office of the Superintendent of Financial Institutions nor the investments that are held by the Public Sector Investment Board.

The following table provides details of the RCMP Pension Plan Pension Accounts:

| 2007 | 2006 Restated (note 17) |

|

|

(in thousands of dollars) |

||

| RCMP Superannuation Account | 11,640,609 | 11,255,481 |

| RCMP Pension Fund Account | 11,140 | 16,563 |

| Retirement Compensation Arrangement Account | 22,258 | 21,025 |

| Dependents Pension Fund Account | 29,409 | 29,745 |

| 11,703,416 | 11,322,814 | |

10. Deferred Revenue

| 2007 | 2006 Restated (note 17) |

|

|

(in thousands of dollars) |

||

| Deferred revenue – Contract policing arrangements on capital assets, beginning of year | 75,084 | 100,269 |

| Increase in net book value of contract policing capital assets | 28,100 | – |

| Revenue recognized | – | (25,185) |

| Deferred revenue – contract policing arrangements on capital assets, end of year | 103,184 | 75,084 |

| Deferred revenue – Donation and bequest accounts, beginning of year | 444 | 531 |

| Contributions received | 128 | 150 |

| Revenue recognized | (155) | (237) |

| Deferred revenue – Donation and bequest accounts, end of year | 417 | 444 |

| Deferred revenue – Registration fees, beginning of year | ||

| Application request and registration fees received | 152 | – |

| Revenue recognized | ||

| Deferred revenue – Registration fees, end of year | 152 | – |

| Total deferred revenue | 103,753 | 75,528 |

Deferred revenue consists of three categories: deferred revenue for contract policing arrangements on tangible capital assets, deferred revenue for donation and bequest accounts and deferred revenue for registration fees.Deferred revenue for contract policing arrangements on tangible capital assets represents the balance of revenue received at the time of acquisition of tangible capital assets owned by RCMP and dedicated for usage to meet contractual obligations over the life of the asset. The deferred revenue is earned on the same basis as the amortization of the corresponding capital asset.Deferred revenue for donation and bequest accounts represents the balance of contributions received for various purposes. They are recognized as revenue when the funds are expended for the specified purposes. Deferred revenue for registration fees represents the application fee received from clients where the application processing has not reached a sufficient stage to warrant recognizing revenue. They are recognized as revenue when the eligibility checks point of application is processed.

11. Employee benefits

(a) Pension benefits (Public Service employees): The department’s public service employees participate in the Public Service Pension Plan, which is sponsored and administered by the Government of Canada. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with Canada/Qu�bec Pension Plans benefits and they are indexed to inflation.

Both the employees and the department contribute to the cost of the Plan. The 2006-2007 expense amounts to $44 millions ($45 millions in 2005-2006), which represents approximately 2.2 times (2.6 in 2005-2006) the contributions by employees. The department’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan’s sponsor.

(b) Pension benefits (RCMP members): The department’s regular and civilian members participate in the RCMP Pension Plan, which is sponsored by the Government of Canada and is administered by the RCMP. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best five consecutive years of earnings. The benefits are integrated with Canada/Qu�bec Pension Plans benefits and they are indexed to inflation.

Both the members and the department contribute to the cost of the Plan. The 2006-2007 expense amounts to $213 million ($223 million in 2005-2006), which represents approximately 2.5 times (2.9 in 2005-2006) the contributions by members. The department is responsible for the administration of the Plan including determining eligibility for benefits, calculating and paying benefits, developing legislation and related policies, and providing information to Plan members. The actuarial liability and actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan’s sponsor.

(c) Severance benefits: The department provides severance benefits to its employees and RCMP members based on eligibility, years of service and final salary. These severance benefits are not pre-funded. Benefits will be paid from future appropriations. Information about the severance benefits, measured as at March 31, is as follows:

| 2007 | 2006 Restated (note 17) |

|

|

(in thousands of dollars) |

||

| Accrued benefit obligation, beginning of year | 424,744 | 397,840 |

| Expense for the year | 46,952 | 60,774 |

| Benefits paid during the year | (32,243) | (33,870) |

| Accrued benefit obligation, end of year | 439,453 | 424,744 |

12. Other liabilities

| 2007 | 2006 Restated (note 17) |

|

|

(in thousands of dollars) |

||

| Benefit Trust Fund | 2,312 | 2,229 |

| Contractor Securities | – | 119 |

| Environmental Liabilities | 3,752 | 2,549 |

| Other | 2,355 | 1,682 |

| Total other liabilities | 8,419 | 6,579 |

Benefit Trust Fund: This account was established by section 23 of the Royal Canadian Mounted Police Act, to record moneys received by personnel of the Royal Canadian Mounted Police, in connection with the performance of duties, over and above their pay and allowances. Receipts of $219,719 ($161,801 in 2006) were received in the year and payments of $136,650 ($96,308 in 2006) were issued. The fund is use for (i) the benefit of members, former members and their dependants; (ii) as a reward, grant or compensation to any person who assists the RCMP in the performance of its duties in any case where the Minister is of the opinion that such person is deserving of recognition for the services rendered; (iii) as a reward to any person appointed or employed under the authority of the RCMP Act for good conduct or meritorious service, and (iv) for such other purposes that would benefit the RCMP as the Minister may direct.

13. Contingent Liabilities

(a) Contaminated sites

Liabilities are accrued to record the estimated costs related to the management and remediation of contaminated sites where the department is obligated or likely to be obligated to incur such costs. The department has identified approximately 17 sites (18 sites in 2006) where such action is possible and for which a liability of $3,752,007 ($2,549,512 in 2006) has been recorded. The department’s ongoing efforts to assess contaminated sites may result in additional environmental liabilities related to newly identified sites, or changes in the assessments or intended use of existing sites. These liabilities will be accrued by the department in the year in which they become known.

(b) Claims and litigation

Claims have been made against the department in the normal course of operations. Legal proceedings for claims totalling approximately $84 millions ($46 millions in 2006) were still pending at March 31, 2007. Some of these potential liabilities may become actual liabilities when one or more future events occur or fail to occur. To the extent that the future event is likely to occur or fail to occur, and a reasonable estimate of the loss can be made, an estimated liability is accrued and an expense recorded in the financial statements.

(c) Pension litigation

The Public Sector Pension Investment Board Act which received Royal Assent in September 1999 amended the RCMPSA to enable the federal government to deal with excess amounts in the RCMP Superannuation Account and the RCMP Pension Fund. The legal validity of these provisions has been challenged in the courts. The outcome of these lawsuits is not determinable at this time.

14. Contractual Obligations

The nature of the RCMP’s activities can result in some large multi-year contracts and obligation whereby the RCMP will be obligated to make future payments when the services/goods are received.Significant contractual obligations that can be reasonably estimated are summarized as follows:

| (in thousands of dollars) |

2007 | 2008 | 2009 | 2010 | 2011 and thereafter | Total |

| Services agreement | 10,000 | 10,000 | 10,000 | 9,268 | – | 39,268 |

| Total | 10,000 | 10,000 | 10,000 | 9,268 | – | 39,268 |

15. Related Party Transactions

The RCMP is related as a result of common ownership to all Government of Canada departments, agencies, and Crown corporations. The RCMP enters into transactions with these entities in the normal course of business and on normal trade terms. Also, during the year the RCMP received without charge from other departments, accommodation, the employer’s contribution to the health and dental insurance plans, worker’s compensation and legal services. These services without charge have been recognized in the department’s Statement of Operations as follows:

| Services received without charge from other government departments |

2007 | 2006 Restated (note 17) |

|

(in thousands of dollars) |

||

| Accommodation provided by Public Works and Government Services Canada | 60,579 | 49,563 |

| Contributions covering employers’ share of employees’ insurance premiums and expenditures by the Treasury Board Secretariat | 158,070 | 149,197 |

| Workers’ compensation cost provided by Human Resources Canada | 381 | 522 |

| Legal services provided by Department of Justice | 2,425 | 2,573 |

| Total | 221,455 | 201,855 |

The Government has structured some of its administrative activities for efficiency and cost-effectiveness purposes so that one department performs these on behalf of all without charge. The costs of these services, which include payroll and cheque issuance services provided by Public Works and Government Services Canada, are not included as an expense in the department’s Statement of Operations.

16: Comparative information

Comparative figures have been reclassified to conform to the current year’s presentation.

17. Restatement of prior year’s figure

It should be noted that in May 2006, the Minister of Public Safety and Emergency Preparedness announced the transfer of the Canada Firearms Centre to the Royal Canadian Mounted Police (RCMP). Current year’s financial statements and comparative figures represent combined financial statements of Canada Firearms Centre and Royal Canadian Mounted Police.

Table 16: Response to Parliamentary Committees, and Audits and Evaluations for Fiscal Year 2006–2007

|

Response to Parliamentary Committees |

|

N/A |

|

Response to the Auditor General including to the Commissioner of the Environment and Sustainable Development (CESD)

|

|

External Audits (Note: These refer to other external audits conducted by the Public Service Commission of Canada (PSC), the Office of the Commissioner of Official Languages. (OCOL), or Privacy Commissioner (PC). N/A |

|

Project

|

Comments

|

Estimated Start

|

Estimated Completion

|

| Internal Audits | |||