Common menu bar links

Breadcrumb Trail

ARCHIVED - Office of the Superintendent of Financial Institutions Canada

This page has been archived.

This page has been archived.

Archived Content

Information identified as archived on the Web is for reference, research or recordkeeping purposes. It has not been altered or updated after the date of archiving. Web pages that are archived on the Web are not subject to the Government of Canada Web Standards. As per the Communications Policy of the Government of Canada, you can request alternate formats on the "Contact Us" page.

SECTION I - OVERVIEW

Message from the Superintendent

On behalf of the Office of the Superintendent of Financial Institutions Canada (OSFI), I am pleased to present to Parliament our Report on Plans and Priorities for 2008-2009.

As Canada's federal prudential regulator, OSFI has a mandate to protect the rights and interests of depositors, policyholders and pension plan members, while allowing financial institutions to take reasonable risks and compete effectively. The financial services industry is dynamic - rapidly changing both in Canada and around the world. Over the past several months there has been turbulence in global financial markets with which has come increased risk to financial institutions globally, including in Canada.

OSFI has established a long-term priority that involves focusing on the changing risk environment, by enhancing our ability to identify risks and their impact on financial institutions and pension plans, and using that increased understanding to adjust supervisory and regulatory expectations.

|

The priority involves increasing our surveillance of markets to better determine the impacts of events on financial institutions. In concert with this initiative, OSFI is also planning more comparative reviews. We will benchmark how banks manage liquidity risk, the rigour of their stress testing, the robustness of their valuation processes, as well as their securitization activities. In the life insurance sector, commercial real estate activities will be reviewed, and in the banking sector, US commercial real estate activities will be reviewed.

In support of its prudential mandate, OSFI has several ongoing activities. These include: accurate risk assessments of financial institutions and pension plans, and timely, effective intervention and feedback; promoting a balanced and relevant regulatory framework of guidance and rules that meets or exceeds international minimums; and a prudentially effective, balanced and responsive approvals process. Ensuring that OSFI has the human resources available to fulfil its mandate, through better long-range, integrated planning is of key importance.

In the longer term, OSFI will continue work to strengthen Canada's system of prudential regulation. Related to this goal is OSFI's continued participation in international discussions, including the Financial Stability Forum, the Basel Committee on Banking Supervision, and the International Association of Insurance Supervisors, to identify and discuss events arising from global financial market turmoil. In addition, OSFI will continue its support for: domestic implementation of the Basel II Capital Accord; preparations for the move from Canadian GAAP to International Financial Reporting Standards (IFRS); development of a more risk-based capital framework for life insurance companies over the next five years; and the enhancement of OSFI's ability to perform in an increasingly complex pensions market.

As well, the International Advisory Group will continue to contribute to international financial stability by assisting emerging market economies in enhancing their regulatory and supervisory systems.

The Office of the Chief Actuary will provide ongoing expert valuation and advice for actuarial reports including the Canadian Pension Plan (CPP), Old Age Security Program (OAS), and federal public sector employee pension and insurance plans established under various Acts.

|

The 2008-2009 Report on Plans and Priorities identifies some new initiatives and ongoing responsibilities that form the core elements of OSFI's program delivery, and will enable OSFI to maintain its position as a world-class prudential regulator into the future. In meeting these goals, OSFI will continue to contribute to a strong and prosperous Canadian financial system, a system in which Canadians can put their reliance and their trust.

Management Representation Statement

|

OSFI's Raison d'être

OSFI supervises and regulates all federally incorporated or registered deposit-taking institutions (e.g., banks), life insurance companies, property and casualty insurance companies, and federally regulated private pension plans.

OSFI safeguards depositors, policyholders and private pension plan members by enhancing the safety and soundness of federally regulated financial institutions and private pension plans. The work of OSFI contributes to the confidence of Canadians in Canada's financial system.

The Office of the Chief Actuary (OCA) is a separate unit within OSFI. The OCA provides high-quality, timely advice on the state of various public pension plans and on the financial implications of options being considered by policy makers. The work of the OCA contributes to the confidence of Canadians in Canada's public retirement income system.

Organizational Information

Mandate

OSFI's legislated mandate was established in 1996 and changes are not expected in the 2008-2011 planning period. Under the legislation, OSFI's mandate is to:

- Supervise federally regulated financial institutions and private pension plans to determine whether they are in sound financial condition and meeting minimum plan funding requirements respectively, and are complying with their governing law and supervisory requirements;

- Promptly advise institutions and plans in the event there are material deficiencies and take, or require management, boards or plan administrators to take, necessary corrective measures expeditiously;

- Advance and administer a regulatory framework that promotes the adoption of policies and procedures designed to control and manage risk;

- Monitor and evaluate system-wide or sectoral issues that may impact institutions negatively.

OSFI's legislation says that, even though regulation and supervision reduce the risk of failure, regulation and supervision have to be carried out recognizing that institutions are run by their management and boards, that they carry on business in a competitive environment that requires them to manage risk, but that they can face financial and funding problems that can lead to their failure.

Long-Term Business Priority

For this planning cycle, OSFI has formally added a Long-Term Business Priority to its planning processes, which is:

We will focus on the changing risk environment by:- Improving our ability to understand the changing risk environment and how it might affect financial institutions and pension plans;

- Using that increased understanding to adjust our supervisory and regulatory expectations of financial institutions and pension plans.

To achieve our Long-Term Priority, OSFI recognizes that:

Our employees are key to our success.The Long-Term Priority is intended to help OSFI prioritize its work according to risks. OSFI's core work continues to be important and will contribute to meeting the Long-Term Priority.

Governance and Accountability

OSFI's accountability framework is made up of a variety of elements. OSFI participates in established international reviews jointly led by the World Bank/International Monetary Fund to determine whether OSFI is meeting internationally established principles for prudential regulators. OSFI regularly conducts anonymous surveys of knowledgeable observers1 on its operations, consults extensively on its regulatory rules before they are finalized, issues an annual report and has its financial statements audited annually by the Auditor General. Related reports are disclosed on OSFI's web site.

OSFI's internal audit group conducts assurance audits based on a comprehensive five-year risk-based plan. Audit results are reviewed by the Executive and OSFI's Audit Committee at regularly scheduled meetings. (OSFI strengthened its Audit Committee in 2005-2006 by appointing four independent members. For more information on OSFI's Audit Committee, visit About OSFI/Audit Committee on OSFI's web site.)

The Office of the Chief Actuary (OCA) was established within the organization as a separate unit to provide actuarial and other services to the Government of Canada and provincial governments, which are Canada Pension Plan (CPP) stakeholders. The accountability framework for the OCA, as established by OSFI, makes clear that the Chief Actuary is solely responsible for actuarial opinions made by the Office. More information is available on OSFI's web site under the Office of the Chief Actuary.

1Knowledgeable observers are defined to meet the parameters of each specific consultation undertaken. In general, these are senior executives and professionals representing the stakeholder group.

Key Partners

OSFI works with a number of key partners in advancing its strategic outcomes. Together, these departments and agencies constitute Canada's network of financial regulation and supervision and provide a system of deposit insurance. On a federal level, partnering organizations include the Department of Finance (www.fin.gc.ca), the Bank of Canada (www.bank-banque-canada.ca), the Canada Deposit Insurance Corporation (www.cdic.ca), the Financial Consumer Agency of Canada (www.fcac-acfc.gc.ca), and the Financial Transactions and Reports Analysis Centre of Canada (www.fintrac.gc.ca), among others.

In addition, OSFI collaborates with certain provincial and territorial supervisory and regulatory agencies, as necessary, and with private-sector organizations and associations, particularly in rule making. OSFI plays a key role in the International Association of Insurance Supervisors (www.iaisweb.org) and international organizations such as the Basel Committee on Banking Supervision (www.bis.org/bcbs/index.htm).

Maintaining good relationships with these organizations is critical to OSFI's success. OSFI reviews, on an annual basis, its involvement with these organizations to ensure it is maximizing the effective use of resources.

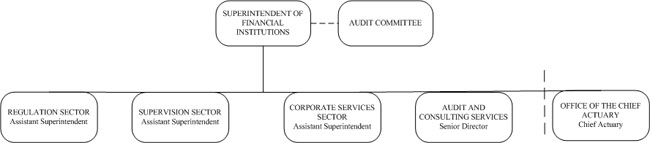

Organizational Structure

OSFI comprises three sectors, each headed by an Assistant Superintendent. Each sector works interdependently to achieve OSFI's strategic outcomes. In addition, there is an independent Internal Audit and Consulting function that reports directly to the Superintendent.

The Office of the Chief Actuary (OCA), a separate unit within OSFI, provides effective actuarial and other services to the Government of Canada and provincial governments that are Canada Pension Plan (CPP) stakeholders.

OSFI Organization Chart, as at December 31, 2007

Program Activity Architecture

In 2005, OSFI developed a new Program Activity Architecture, and began reporting on that basis in the Report on Plans and Priorities and the Departmental Performance Report in 2006.

| Strategic Outcome | Program Activities | ||||

|

|

||||

|

|||||

|

|||||

|

|

Financial Information

Background

OSFI recovers its costs from several revenue sources. Costs for risk assessment and intervention (supervision), approvals and rule making are charged to the financial institutions and private pension plans that OSFI regulates and supervises.

The amount charged to individual institutions for OSFI's main activities of supervision, approvals and rule making is determined in several ways. In general, the system is designed to allocate costs based on the approximate amount of time spent supervising and regulating institutions. As a result, well-managed, lower-risk institutions bear a smaller share of OSFI's costs.

Specific user fees cover costs for certain approvals. Problem (staged) institutions are assessed a surcharge approximating the extra supervision resources required. Service charges apply to new applicants that are not subject to a base assessment and for rulings, interpretations, capital quality confirmations and copies of corporate documents, which are often resource intensive.

OSFI also receives revenues for cost-recovered services. These include revenues from the Canadian International Development Agency (CIDA) for international assistance, revenues from provinces for which OSFI does supervision on contract, and revenues from other federal agencies for which OSFI provides administrative support. Effective 2002-2003 to October 31, 2007, cost-recovered services revenue also included amounts charged separately to major banks for the implementation of the internal ratings-based approach of the New Basel Capital Accord. These cost-recovery Memoranda of Understanding expired on November 1, 2007 and any ongoing Basel II costs are now recovered through base assessments.

The remainder of the costs of risk assessment and intervention, approvals and rule making are recovered through base assessments against institutions and private pension plans fees according to various formulae.

The Superintendent can impose monetary penalties in respect of specific violations, as designated in the schedule to the Administrative Monetary Penalties (OSFI) Regulations, including penalties from financial institutions that submit late and/or erroneous financial and non-financial returns. These penalties are billed quarterly, collected and remitted to the Consolidated Revenue Fund. By regulation, OSFI cannot use these funds, which are recorded as non-respendable revenue, to reduce the amount that it assesses the industry in respect of its operating costs.

The Office of the Chief Actuary is funded by fees charged for actuarial services and in part by an annual parliamentary appropriation for services to the Government of Canada related to public pensions.

OSFI's financial statements are prepared using Generally Accepted Accounting Principles (GAAP), are audited annually by the Office of the Auditor General and are published in OSFI's Annual Report. OSFI's annual reports can be accessed on OSFI's web site under About OSFI / Reports / Annual Reports.

NOTE: OSFI follows the accrual basis of accounting and the financial tables are reported on a modified cash basis of accounting, in accordance with Treasury Board requirements. Hence, there are differences between OSFI's audited financial statements and the tables contained herein. Typically the differences result from variations in the treatment of capital expenditures and accounts receivable between the two accounting bases.

Financial Tables

In accordance with the Treasury Board Secretariat's Guide to the Preparation of Part III of the 2008-2009 Estimates, the financial and human resources presented in this Report on Plans and Priorities reflect OSFI's approved Annual Reference Level Update (ARLU) estimates, which were prepared in early summer 2007. More recent events in the global financial system are requiring that OSFI direct more resources on enhanced identification of emerging risks and on monitoring institutional and market resilience to the turmoil. OSFI's capacity to proactively monitor these emerging risks and assess their impact on the financial institutions and pension plans that it regulates is under review and may result in increases to the resource levels presented in the following tables, particularly in the Supervision Sector. At time of writing this Report on Plans and Priorities, OSFI was completing its business planning process for 2008-2009 to 2010-2011. Any changes as a result will be reflected in next year's Report on Plans and Priorities.

OSFI continues to re-evaluate its programs to ensure that they contribute to OSFI's mandate and are efficiently managed. In so doing, OSFI has been successful at minimizing ongoing operating cost increases and at judiciously managing its human resources in optimal ways.

Summary Information

Resources

Financial Resources ($ millions)| 2008-2009 | 2009-2010 | 2010-2011 |

| $93.7 | $102.9 | $100.7 |

Human Resources Average Full-Time Equivalents (FTEs)

| 2008-2009 | 2009-2010 | 2010-2011 |

| 471 | 467 | 467 |

More financial tables follow:

Voted and Statutory Items Displayed in the Main Estimates

OSFI Planned Spending and Average Full-Time Equivalents

Table 5 Services Received Without Charge

Table 6 Sources of Respendable and Non-respendable Income

Table 7 Summary of Capital Spending by Program Activity

Voted and Statutory Items Displayed in the Main Estimates

This table summarizes Parliament's voted appropriation and the statutory provision for the spending of revenues arising out of the operations of the Office.

OSFI receives an annual parliamentary appropriation pursuant to section 16 of the OSFI Act to support its mandate relating to the Office of the Chief Actuary. This parliamentary appropriation is to defray the expenses associated with the provision of actuarial services to various public sector employee pension and insurance plans, including the Canadian Armed Forces, the Royal Canadian Mounted Police, the federally appointed judges and Members of Parliament.

Subsequent to the tabling of the 2007-2008 Main Estimates, OSFI's appropriation for that fiscal year was increased from $784 thousand to $873 thousand for adjustments granted by the Treasury Board related to collective agreements for the Office of the Chief Actuary. The planned decrease in OSFI's appropriation to $853 thousand in 2008-2009 is due to non-recurring adjustments that are included in the 2007-2008 appropriation of $873 thousand.

Pursuant to section 17(2) of the OSFI Act under statutory provision OSFI may spend any revenue arising out of the operations of the Office.

Voted and Statutory Items Displayed in the Main Estimates| Vote Item | ($ thousands) | 2007-2008 Main Estimates |

2008-2009 Main Estimates |

| 30 | Program expenditures | 784 | 853 |

| (S) | Spending of revenues pursuant to subsection 17(2) of the Office of the Superintendent of Financial Institutions Act (R.S., 1985, c. 18 (3rd Supp.)) | 0 | 0 |

| Total Agency | 784 | 853 |

OSFI Planned Spending and Average Full-Time Equivalents

Total gross Budgetary Main Estimates are planned to increase by 5.0% from 2007-2008 to 2008-2009, due primarily to the increase in human resources and the full-year impact in 2008-2009 of employees hired during 2007-2008, normal inflationary and merit adjustments and continued annual capital investments in information systems related to: changes in Accounting Rules and Standards and the Minimum Continuing Capital Surplus Requirement (MCCSR); supporting the Private Pension Plans program; and a significant version upgrade to OSFI's Electronic Document Management System.

Total gross Budgetary Main Estimates are planned to increase by 9.8% from 2008-2009 to 2009-2010, due primarily to the renewal of OSFI's Toronto office lease at market rates, which are estimated to be 65% higher than the current lease (which was negotiated in 1994). Coinciding with the lease renewal, OSFI is also planning an accommodation retrofit in Toronto in order to utilize its space more efficiently and align its accommodation standards more closely to those established by Public Works and Government Services Canada. The decrease in 2010-2011 is largely due to the completion of the accommodation retrofit in the preceding year, partially offset by increases associated with normal inflationary and merit adjustments.

The Total Forecast Spending for 2007-2008 is $873 thousand. The slight decrease to $853 thousand in 2008-2009 and beyond is due to non-recurring items in the previous year (refer to the Voted and Statutory Items section on the previous page).

OSFI's total planned spending and average full-time equivalent (FTE) complement over the three-year planning period are displayed in this table.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Priorities

OSFI's priorities include its key ongoing responsibilities, as required to meet its mandate, as well as specific program and management priorities.

| Key Ongoing Responsibilities | Type |

| 1.1 Regulation and Supervision of Federally Regulated Financial Institutions | Ongoing |

| 1.2 Regulation and Supervision of Federally Regulated Private Pension Plans | Ongoing |

| 1.3 International Assistance | Ongoing |

| 2.0 Office of the Chief Actuary | Ongoing |

| Management and Program Priorities | Type |

| A. Enhanced Identification of Emerging Risks | New |

| B. Institutional and Market Resilience | New |

| C. Changes to International Financial Reporting Standards (IFRS) | Previously committed |

| D. Minimum Continuing Capital Surplus Requirement (MCCSR) | Previously committed |

| E. Financial Sector Assessment Program (FSAP)/ Financial Action Task Force (FATF) Reviews | Previously committed |

| F. Basel II Capital Accord - Post-Implementation Phase | Previously committed |

| G. People | Previously committed |

| H. Pensions Systems and Processes | Previously committed |

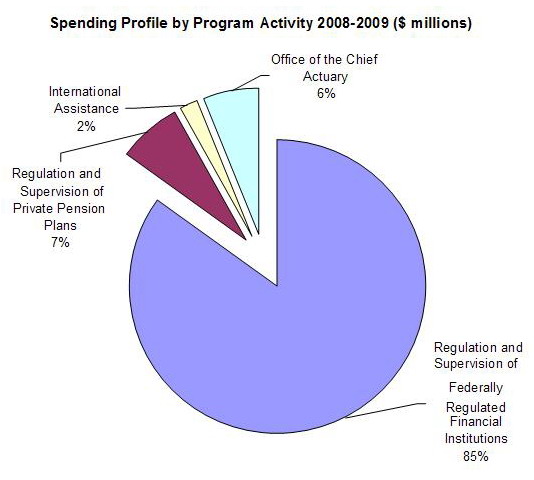

Program Activities by Strategic Outcome

| Strategic Outcome | Program Activities | Planned Spending ($ millions) |

||||||

| 2008-2009 | 2009-2010 | 2010-2011 | ||||||

|

|

$79.6 | $88.2 | $85.7 | ||||

|

$6.5 | $6.8 | $6.9 | |||||

|

$1.9 | $2.0 | $2.0 | |||||

|

|

$5.7 | $5.9 | $6.1 | ||||

Program Activities by Strategic Outcome

| Expected Results | Planned Spending ($ millions) |

||||

| 2008-2009 | 2009-2010 | 2010-2011 | Planned spending includes resources related to the following priorities | ||

|

Strategic Outcome 1

Regulate and supervise to contribute to public confidence in Canada's financial system and safeguard from undue loss. |

|||||

|

Program Activity 1.1

Regulation and supervision of federally regulated financial institutions |

Protect depositors and policyholders while recognizing that all failures cannot be prevented. | $79.6 | $88.2 | $85.7 | |

|

Sub-activity 1.1.1

Risk assessment and intervention |

Accurate risk assessments. | $54.7 | $60.4 | $58.8 | Priorities A, B, E, F and G |

|

Sub-activity 1.1.2

Rule making |

Regulations, Guidelines and other rules that balance prudential considerations and the need for institutions to compete. | $16.4 | $18.3 | $17.7 | Priorities C, D, E, F and G |

|

Sub-activity 1.1.3

Approvals |

Regulatory approvals result in prudentially sound decisions that are transparent. | $8.5 | $9.5 | $9.2 | Priority G |

|

Program Activity 1.2

Regulation and Supervision of Federally Regulated Private Pension Plans |

Protect the financial interests of federally regulated private pension plan members and beneficiaries. | $6.5 | $6.8 | $6.9 | Priority G and H |

|

Program Activity 1.3

International Assistance |

Emerging market economies are more informed about current approaches to regulatory and supervisory systems, and deploy them to the extent possible. | $1.9 | $2.0 | $2.0 | Priority G |

|

Strategic Outcome 2

Contribute to public confidence in Canada's public retirement income system. |

|||||

|

Program Activity 2.1

Office of the Chief Actuary |

Stewards of Canada's public retirement income system are provided with professional actuarial services and advice in regard to the Canada Pension Plan (CPP) and federally legislated public pension and benefit plans. | $5.7 | $5.9 | $6.1 | Priority G |

Note: Internal Services are considered part of every Program Activity. Internal Services consist of Management and Oversight, Human Resources Management, Financial Management, Supply Chain Management, Facilities/Asset Management, Information Management, Information Technology, Legal, Public Affairs/Communications, Evaluation, Internal Audit and Other Support Delivery Services.

Operating Environment

Regulated Entities

OSFI supervises and regulates all federally incorporated or registered deposit-taking institutions (e.g., banks), life insurance companies, property and casualty insurance companies, and federally regulated private pension plans. These 1,785 organizations managed a total of $3,375 billion of assets (as at March 31, 2007).

Federally Regulated Financial Institutions and Private Pension Plans & Related Assets| Deposit- Taking Institutions | Life Insurance Companies | Property & Casualty Companies | Private Pensions Plans | Total | |

| Number of organizations | 148 | 114 | 191 | 1,332 | 1,785 |

| Assets $B | 2,679 | 463 | 103 | 130 | 3,375 |

OSFI also undertakes supervision of provincially incorporated financial institutions on a cost-recovery basis under contract arrangements with some provinces. Additional detail may be found on OSFI's web site under About OSFI / Who We Regulate.

Key Risks and Threats

Due to the growing demand for Canadian commodities, particularly from Asia, the Canadian economy is operating at full capacity. Unemployment is at historical lows, inflation is under control, and the price of the Canadian dollar in American dollars is close to parity. The consensus view is one of continued growth of the Canadian economy, albeit with serious downside risks. Canada is the only G7 country experiencing both a budget surplus and a merchandise trade surplus. The strong Canadian dollar has created difficulties for a number of export sectors, particularly manufacturing and cross-border tourism. The major downside risk to the Canadian economy is a serious economic downturn.

Pressures on the balance sheets of the large money-centre banks and broker-dealers from off-balance sheet conduits, leveraged buyout loans, and stalled structured finance transactions raise risks that could generate a lack of confidence in the Canadian economy.

The turmoil in financial markets, which began in the spring of 2007 in the U.S. subprime market and quickly spread to financial markets everywhere, demonstrated once again that financial markets around the globe are inextricably linked. Central banks were called upon to provide liquidity in support of the efficient functioning of money markets. They continue to closely monitor financial market developments and the need for the provision of liquidity. At the same time, regulators of financial institutions have been closely monitoring the balance-sheet and off-balance-sheet activities of regulated financial institutions. By and large, the banking system internationally is weathering the crisis, albeit with many incurring costs, some significant, others, less so.

As the adjustments in financial markets unfold, OSFI continues to closely monitor Canadian banks and to work with the Bank of Canada and other regulators to promote the resilience of the Canadian financial system. Continued vigilance by all financial market participants is called for, not only as market dislocations run their course, but on an ongoing basis.

The US has recently made statements of importance on International Financial Reporting Standards. The Securities and Exchange Commission will accept IFRS financial statements without reconciliation to US GAAP starting in 2008. As well, US Accounting Standards Board Chairman, Bob Hertz, has recently spoken on the US not just converging with IFRS but how to move towards adopting IFRS.

The decision of the Canadian Accounting Standards Board to adopt international accounting standards by 2011 will mean that a separate and distinct Canadian GAAP will cease to exist. As financial institutions will be required to adhere to these new standards, these accounting standard changes will require analysis by OSFI for impacts to our policies, legislation, data collection and reporting. OSFI will continue to have close discussions with accounting standard setting bodies, industry associations and specific institutions as we determine the impacts to these areas.

Canadian banks began implementation of Basel II in November 2007. OSFI expects to continue working closely with Canadian banks and international counterparts to ensure integration of the Accord into the business processes of the banks. The Accord will result in more risk-sensitive measures of capital.

Enterprise Risk Management

The environment within which OSFI operates presents an array of challenges to the achievement of its mandate and objectives. While many of these challenges are consistently present, the extent to which they present a risk to OSFI's objectives varies, depending on economic and financial conditions and the financial industry environment. OSFI's ability to achieve its mandate depends on

the timeliness and effectiveness with which it identifies, evaluates, prioritizes, and develops initiatives to address areas where its exposure is greatest. To that end, in the fall of 2007, OSFI's Executive instituted changes to the organization's risk management process to ensure greater timeliness of information and greater focus on our most critical areas (the work that we do and

the skill sets needed by our employees). Quarterly updates to the Executive will now be embedded in OSFI's Enterprise Risk Management process.

OSFI's Enterprise Risk Management (ERM) framework divides risks into external and internal categories. The external risk category consists of economic and financial conditions, the financial industry environment, OSFI's legal environment and catastrophic events. External risks arise from events that OSFI cannot influence, but must be able to monitor in order to mitigate the impact. The internal risk category consists of risks that can broadly be categorized as people, processes, systems, and culture.

OSFI's ERM program has identified several key risks to the achievement of its mandate and objectives.

External Risks

Shocks to the economy and cyclicality in the industry

Various events over the past few years have focussed the attention of financial institutions and their regulators on their ability to respond adequately in a crisis, both from a prudential and a human resources perspective. The turmoil being experienced by financial markets around the world, which began in the spring of 2007 as a result of the U.S. subprime mortgage market, will cause

OSFI, like all global financial regulators, to continue to closely monitor the balance-sheet and off-balance-sheet activities of regulated financial institutions. Also, financial institutions face risks as a result of changes in the economic environment. For example, an economic downturn could stretch OSFI's resources and affect its ability to supervise effectively and intervene in a

timely fashion.

Basel II Capital Accord

The new international capital framework will have major implications for financial institutions and OSFI. In particular, the new framework encourages larger banks to use enhanced risk-based measures of business performance to drive their internal assessment of capital needs.

The new capital framework and events in the market also require banks and regulators to focus more on the measurement of risks and its relation to the overall level of capital adequacy. Due to the scale and novelty of this undertaking, there is a risk that review work for Basel II implementation will continue to require more resources than expected by both financial institutions and OSFI, in order to understand the performance of new Basel-related systems over time.

Accounting

The Canadian Accounting Standards Board has decided to adopt international financial reporting standards (IFRS) in 2011. This will have an impact both on OSFI, as it relies on audited financial information, and the institutions it regulates. Key accounting changes will affect insurance, consolidation, business combinations, financial instruments, revenue recognition and measurement of

fair value. As a reliance-based regulator, it is crucial that OSFI understand the implications of changes to financial statements to perform accurate risk assessments of financial institutions.

Minimum Continuing Capital Surplus Requirement (MCCSR)

The International Association of Insurance Supervisors (IAIS) is revising its capital framework to make capital requirements more risk sensitive. There is a need to develop more advanced risk measurement techniques to be incorporated into the MCCSR, while maintaining the integrity of the existing capital test. At the same time, the current MCCSR should be maintained as a fallback

approach for life insurance companies that do not use models, yet be updated to reflect changes in accounting and actuarial standards that affect the measurement of risk and available capital. To date, Canada has been at the forefront of insurance regulation; adjustments to MCCSR will be necessary to ensure that OSFI can maintain its position among the international leaders in this

field.

Internal Risks

People Risks

The financial industry is becoming more complex. OSFI must have staff with sufficient skills to regulate and supervise financial institutions and identify significant issues. In addition, there is a need for continuous learning to meet the challenge of a changing environment. OSFI's staffing levels have reflected a very strong economic environment for financial institutions in general

over the past several years. Changes in that environment may require additional staffing, particularly if more than one sector is affected, e.g., banks, trust companies, property and casualty companies, life insurance companies and private pension plans.

Attracting, motivating, developing and retaining skilled staff is a top priority for OSFI, particularly the ability to attract and retain staff whose skills are in demand in the financial sector. If OSFI does not place the right resources on the right task, it could constrain OSFI's ability to perform accurate risk assessments and perform effective interventions, if required. This risk is exacerbated by the increased risk of changes to the economy.

Pensions Systems and Processes

The changing external environment for pensions, which includes increasing complexity of the work and a litigious environment, demands greater skill on the part of OSFI staff. At the same time, OSFI's internal pensions information system is being upgraded and certain elements such as the adequacy of controls may need to be reviewed. OSFI has started to address both the staff and

systems issues, but work in these areas is not complete. The long time lines for approvals have also been shortened, but further work needs to be done to ensure that delays do not result in reputational risk to OSFI.

Program Delivery

OSFI has a number of key ongoing responsibilities that it must perform to meet its mandate. In addition, in response to the risks and threats that were identified above, OSFI has identified eight program and management priorities. These priorities and ongoing responsibilities are tied to the program activities OSFI undertakes and contribute directly towards achieving OSFI's strategic outcomes. Together these form the main elements of OSFI's program delivery.

|

PROGRAM |

PRIORITIES |

DESCRIPTION |

|

PROGRAM PRIORITIES |

||

| Program Activity 1.1: Regulation and Supervision of Federally Regulated Financial Institutions | ||

|

1.1.1 Program Sub-Activity: Risk Assessment and Intervention |

Ongoing Responsibility - Risk Assessment and Intervention Accurate risk assessments of financial institutions and timely, effective intervention and feedback. |

|

|

|

Priority A - Enhanced Identification of Emerging Risks |

|

|

Priority B - Institutional and Market Resilience |

|

|

|

Priority E - Financial Sector Assessment Program (FSAP)/Financial Action Task Force (FATF) Reviews |

|

|

|

Priority F - Basel II Capital Accord -Post-Implementation Phase |

|

|

|

1.1.2 Program Sub-Activity: Rule Making |

Ongoing Responsibility - Rule Making |

|

|

|

Priority C - Changes to International Financial Reporting Standards (IFRS) |

|

|

|

Priority D - Minimum Continuing Capital Surplus Requirement (MCCSR) |

|

|

1.1.3 Program Sub-Activity: Approvals |

Ongoing Responsibility - Approvals |

|

|

Program Activity 1.2: Regulation and Supervision of Federally Regulated Private Pension Plans |

||

|

Ongoing Responsibility - Pensions |

|

|

|

Priority H - Pension Systems and Processes |

|

|

|

Program Activity 1.3: International Assistance |

||

|

Ongoing Responsibility - International Assistance |

|

|

|

Program Activity 2.1: Office of the Chief Actuary (OCA) |

||

|

Ongoing Responsibility - Office of the Chief Actuary |

|

|

|

MANAGEMENT PRIORITIES |

||

|

|

Ongoing Responsibility - Program Support, Human Resources and Financial Management |

|

|

|

Priority G - People |

|

2Knowledge of Business refers to the development of an understanding of an institution's environment, industry and business profile, which provides the basis for identifying activities that are significant to the achievement of an institution's business objectives.